Recently, there’s been a lot of talk in the energy world about the minerals needed by clean-energy technologies and whether mineral supply problems might pose a threat to the clean-energy transition.

To hold warming beneath 1.5°C over pre-industrial levels, the world must cut greenhouse gas emissions in half by 2030 and reach net zero by 2050. To do that, it must radically ramp up production of solar panels, wind turbines, batteries, electric vehicles (EVs), electrolyzers for hydrogen, and power lines.

Those technologies are far more mineral-intensive than equivalent fossil fuel technologies. “A typical electric car requires six times the mineral inputs of a conventional car,” writes the International Energy Agency (IEA), “and an onshore wind plant requires nine times more mineral resources than a gas-fired plant of the same capacity.” (The IEA report uses the word minerals to refer to the entire mineral and metal value chain from mining to processing operations, and I do the same here.)

Power transmission and distribution require aluminum and copper. Batteries and EVs require cobalt, lithium, and nickel. Wind turbines require rare earth elements. And so on.

In its encyclopedic 2021 report on the subject, IEA estimates that “a concerted effort to reach the goals of the Paris Agreement would mean a quadrupling of mineral requirements for clean energy technologies by 2040. An even faster transition, to hit net-zero globally by 2050, would require six times more mineral inputs in 2040 than today.”

Some individual minerals will see particularly sharp jumps. The World Bank says, “graphite and lithium demand are so high that current production would need to ramp up by nearly 500 percent by 2050 under a [2 degree scenario] just to meet demand.”

A clean-energy transition sufficient to hit 1.5° will mean an enormous rise in demand for these minerals.

This fact has been seized on by a variety of people to raise questions about the speed and sustainability of the clean-energy transition. Are we just trading one resource curse for another?

So I looked into it. It’s a complicated subject — each of these minerals poses its own specific challenges, with its own specific suppliers, supply lines, customers, and possible pain points. There’s no neat single story here.

Nonetheless, I’ll try to summarize what I found, starting at the end, with what I think are the key big-picture lessons. In the next post, we’ll get into specific technologies and minerals.

The clean-energy transition will be an environmental boon

Yes, it is true that demand for minerals will rise and that several of those minerals are currently produced in environmentally and socially problematic ways. This is a real problem — or rather, a whole nest of problems, which warrant concern and concerted action.

That being said, it’s important to keep in mind that, even under the grimmest environmental prognostications, the transition to clean energy will be a boon for humans and ecosystems alike.

It will certainly involve lower greenhouse gas emissions. The World Bank says that, under a 2 degree scenario, through 2050, renewable energy and storage would contribute approximately 16 gigatons of carbon dioxide equivalent (GtCO2e) greenhouse gases, “compared with almost 160 GtCO2e from coal and approximately 96 GtCO2e from gas.”

If the concern is material intensity, energy researcher Saul Griffith has done some back-of-the-envelope calculations that put the transition in perspective. Here’s what he told me:

Assigning all 328 million Americans equal share of our fossil fuel use, every American burns 1.6 tons of coal, 1.5 tons of natural gas, and 3.1 tons of oil every year. That becomes around 17 tons of carbon dioxide, none of which is captured. It is all tossed like trash into the atmosphere.

The same US lifestyle could be achieved with around 110 pounds each of wind turbines, solar modules, and batteries per person per year, except that all of those are quite recyclable (and getting more recyclable all the time) so there is reason to believe it will amount to only 50-100 pounds per year of stuff that winds up as trash.

That is a huge difference: 34,000 pounds of waste for our lifestyles the old way versus 100 pounds the new, electrified way.

These are only illustrative figures, but they show that the scale of resource extraction in a decarbonized world will be vastly, vastly smaller than what’s required to sustain a fossil-fueled society. Close to 40 percent of all global shipping is devoted to moving fossil fuels around, a gargantuan source of emissions (and strain on the ocean) that clean energy will almost wipe out. In a net-zero economy, there will be, on net, less digging, less transporting, less burning, less polluting.

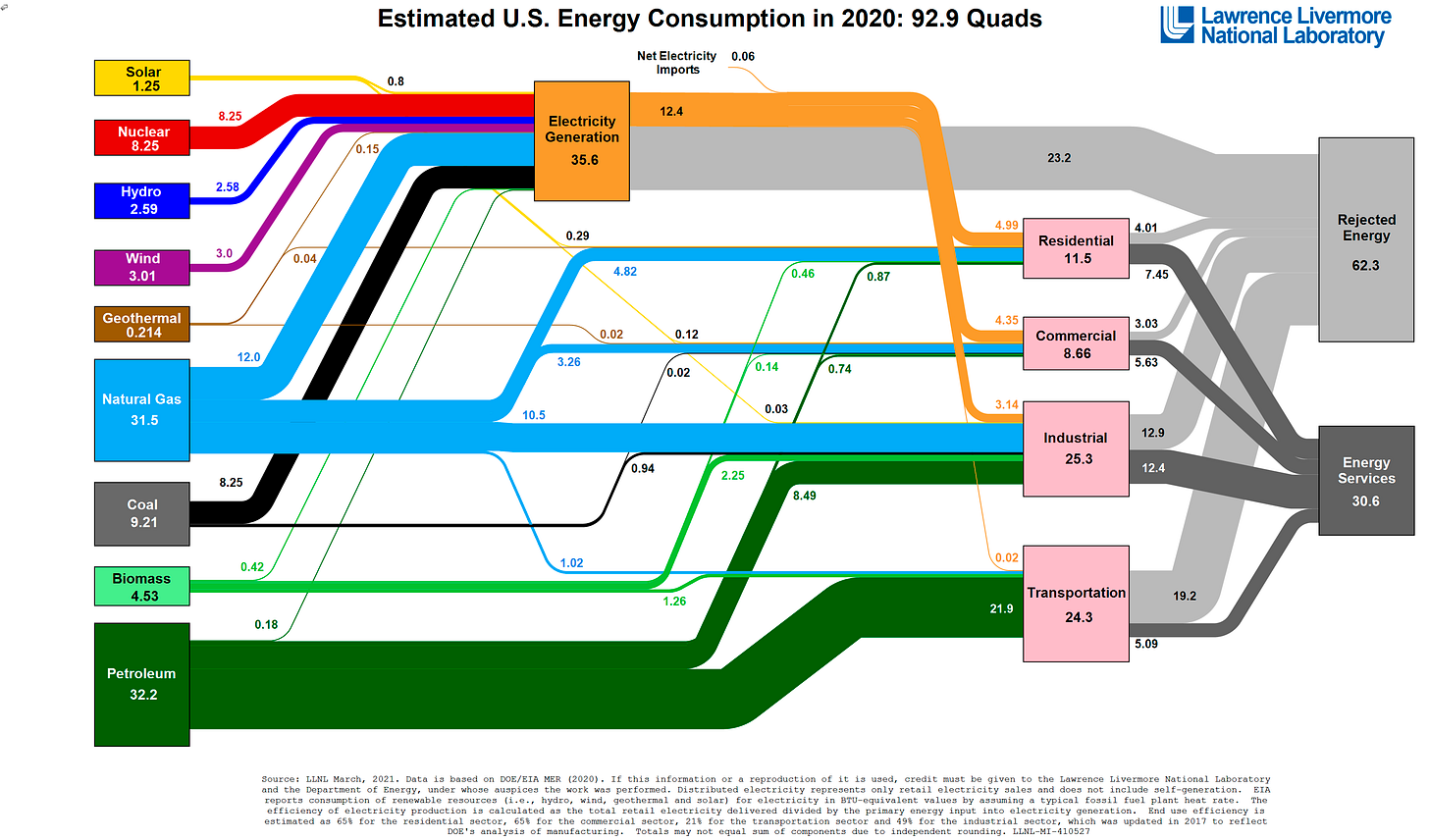

The fact is, fossil fuels are a wildly destructive and inefficient way to power a society. Two thirds of the energy embedded in them ends up wasted.

That inefficiency has been rendered invisible by fossil fuels’ ubiquity and the lack of alternatives. Now that alternatives are coming into view, it’s clear that any shift away from mining, drilling, transporting, and combusting fossil fuels will dramatically ease human pressure on the biosphere and the atmosphere.

Again — I can not emphasize enough — this is no reason to ignore or gloss over the very real environmental impacts of mineral mining, processing, and transport. Though overall environmental pressure will ease in a clean-energy world, it will be concentrated in new places, among people who may not necessarily enjoy the benefits of the transition.

There are ugly and cruel ways to go about an energy transition, and there are sustainable and equitable ways to go about it. I’m strongly in favor of the latter and encourage everyone to do what they can to bring that about.

Nonetheless, either way, the broader cause is environmentally righteous.

These minerals are not rare and there’s no shortage of them

Another common misconception is that the clean-energy transition could fall short because there simply isn’t enough of certain minerals — this especially comes up around the somewhat misleadingly named rare earth elements (REEs).

It’s not true. Known reserves of all these minerals, including REEs, are much higher than demand, and “despite continued production growth over the past decades, economically viable reserves have been increasing for many energy transition minerals,” IEA writes. Reserves will rise further with new exploration and detection methods.

Currently, demand is forecast to grow much faster than supply. As that happens, there are bound to be chokepoints and price fluctuations.

But those stresses will be temporary, especially if policymakers anticipate and prepare for them. New caches of minerals will be found and recycling will increase in scope and effectiveness. There will be supply problems, but there is no Supply Problem, no global scarcity of any mineral that will put a hard limit on the transition.

Minerals do pose risks to the transition

Temporary minerals shortages or disruptions could result in “more expensive, delayed, or less efficient [energy] transitions,” IEA says. Here’s how it summarizes the risks to the transition posed by minerals supply:

(i) higher geographical concentration of production,

(ii) a mismatch between the pace of change in demand and the typical project development timeline,

(iii) the effects of declining resource quality,

(iv) growing scrutiny of environmental and social performance of production, and

(v) higher exposure to climate risk such as water stress, among others.

None of these risks is prohibitive, but if they are not managed, they could slow the transition. Let’s go through them one at a time.

Geographical concentration

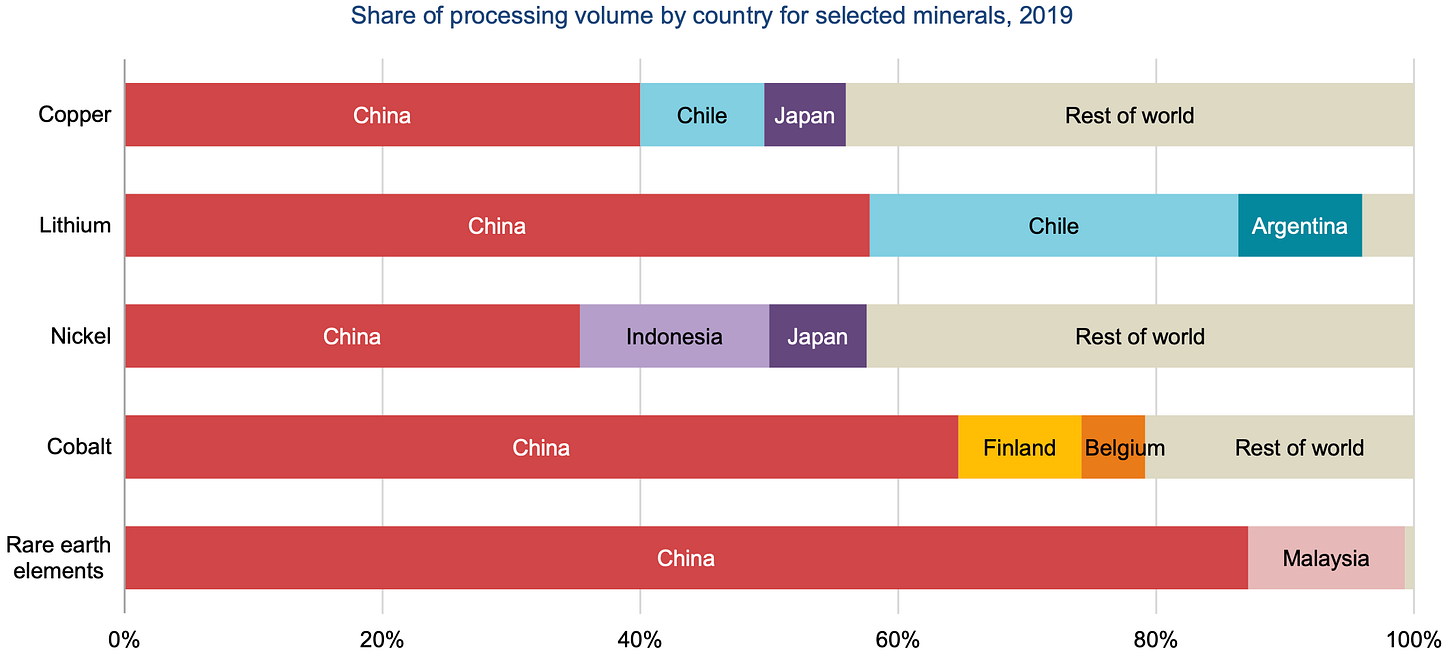

Production of the minerals needed by clean energy technologies is currently more geographically concentrated than oil and gas production.

No single producer dominates in oil and gas markets the way the Democratic Republic of Congo (DRC) dominates cobalt, China dominates graphite and REEs, and Australia dominates lithium.

Similarly, processing of these minerals — refining and preparing them for industrial applications — is highly concentrated, but mostly in one place: China, which processes around 40 percent of copper and nickel, around 60 percent of lithium and cobalt, and around 85 percent of REEs.

The US, like most developed countries, has become highly import-dependent in minerals. According to a recent commentary from scholars at the Colorado School of Mines’ Payne Institute for Public Policy, “of the 35 critical minerals identified by the US today, 14 had a 100% net import reliance in 2020, and 14 additional minerals have a net import reliance of greater than 50%.”

The risk of this concentration is not so much that any one country will try to pull some kind of Bond-villain crippling of the world economy, but simply that the fewer producers or processors involved, the more it matters when any one of them runs into regulatory changes, trade restrictions, or political instability. When there’s a robust ecosystem of producers, one country’s bumps can be absorbed. But when there’s only a handful, any bump ripples out as rapid fluctuations in price.

These markets are relatively small, but will grow quickly under decarbonization, so more and more countries will be vulnerable to price fluctuations. In the oil and gas world, there are energy-security measures in place, including strategic stockpiles of some fuels, but there’s not much of that in place for minerals, at least not yet. And markets for minerals are in many cases much more opaque than markets for oil and gas, lacking a shared set of metrics and transparent pricing.

At least through 2025, IEA does not expect the level of concentration to change much.

Aggressive investment in alternative supplies can decrease concentration eventually, but in the short term, solutions will involve drawing producers into more transparent market frameworks, pressuring them to improve social and environmental performance, and developing some buffer reserves of critical minerals.

Timing mismatch

Demand for minerals is already rising and will accelerate rapidly in coming years. Unfortunately, exploration, discovery, and exploitation of new mineral resources are marked by substantial lead times, in some cases over 15 years.

“These long lead times raise questions about the ability of supply to ramp up output if demand were to pick up rapidly,” IEA writes. “If companies wait for deficits to emerge before committing to new projects, this could lead to a prolonged period of market tightness and price volatility.”

To keep up with demand, investors need to think ahead. And lead times need to decline, which will involve substantial investment and governance help from wealthy consumer nations to poorer producing nations.

Declining resource quality

In recent years, two trends have driven down the average resource quality of many minerals: first, the known high-quality deposits have been mined, and two, technological advances have allowed the mining of ever-lower-quality resources.

“For example,” IEA writes, “the average copper ore grade in Chile has decreased by 30% over the last 15 years.”

As resource quality declines, the emissions intensity of mining rises, as does the amount of waste. Concerted action and investment will be needed to counteract this trend.

ESG scrutiny

A growing chorus of consumers and investors is calling on the mining sector to take action on its labor and environmental standards and rising carbon intensity. They want companies to disclose concrete plans on environmental, social, and governance (ESG) issues.

This is a big deal in the sector, as the majority of production of many key minerals now takes place in countries with low governance scores and/or high emissions intensity.

This is something clean energy advocates have been loath to talk about, but given the coming boom in minerals, silence is no longer an option. The Payne commentary says, “reports have found as many as 255,000 artisanal cobalt miners in the [Democratic Republic of Congo], 35,000 of whom are children working in exceedingly harsh and hazardous conditions to produce the materials many people use in their $100,000 electric vehicles (EVs) and other ‘clean’ technologies.”

Lithium, cadmium, and REEs are all produced in ways that damage soil and water and release hazardous chemicals that threaten miners and surrounding communities. ESG pressure from governments and the private sector could have a salutary effect on social and environmental performance, but it could also place upward pressure on prices and additional burdens on small-scale artisanal miners, which could pose political problems in some countries.

Exposure to climate extremes

Production of clean-energy minerals is increasingly exposed to climate extremes.

Lithium and copper are perhaps the two most important minerals in an electrified world. Over half the world’s lithium production takes place in areas under high water stress. In Chile, 80 percent of copper output comes from arid or water-stressed regions.

Other producing regions like Africa, Australia, and China have seen increased extreme heat and flooding. Expanding demand could push production into even more vulnerable areas.

Anyway, those are the risks. In a later post, I’ll get into strategies and policies that can help address those risks.

Minerals are the new geopolitics: like oil & gas, but not

Right now, clean energy is a fairly small source of demand for the minerals discussed above, but its share is projected to grow rapidly under a Paris-compliant scenario, to well over half of global demand for lithium, cobalt, and nickel by 2040.

Just as clean energy will be more important to minerals markets in coming years, so too will minerals be more important to clean energy. The rapid deployment of technologies crucial to decarbonization is going to depend on supply chains that are in many cases dominated by one or a handful of countries, fed by mines with low labor and environmental standards, exposed to rising climate extremes, and vulnerable to political and economic disruptions. All of those risks could slow the transition.

The race for minerals courts some of the same dangers that came with oil and gas. Minerals will become crucial to the global energy system and their distribution — both production and consumption — will shape geopolitics. Unplanned supply disruptions could have global consequences, just as with oil and gas.

But it’s also important to remember that minerals are different from oil and gas in crucial respects. The most important is that fossil fuel technologies require continuous fuel input. If there’s a disruption in oil markets, it is experienced by every driver as an ongoing increase in gas and diesel prices.

Minerals are only essential to building of clean energy technologies, not to operating them. They are a materials input, not a fuel input. Supply disruptions or price fluctuations will affect markets for the technologies, but they will not affect existing users of those technologies. Solar energy from existing panels will not get more expensive just because copper does. This insulates minerals somewhat from the volatile consumer politics of fossil fuels.

Secondly, every country in the world has an established relationship to oil and gas — it’s a producer or it’s not — but minerals and mineral markets are much more varied and dispersed. Countries could consciously decide to become producers by exploiting new reserves; they could invest in processing or manufacturing; supply chains will shift and morph. “Individual countries may have very different positions in the value chain for each of the minerals,” IEA writes. This makes the geopolitics of minerals more complicated than fossil fuel geopolitics.

As we’ll see in the next post, the exact course of minerals markets is difficult to predict in advance, because there is rapid development and innovation going on in clean energy. Exactly what minerals will constitute the final balance in a clean-energy world is unknowable at this stage.

But there are predictable stresses ahead and policymakers should strive above all not to do what they’ve so often done with oil and gas — namely, stumble blindly into crises that end up having terrible economic and political consequences. The speed and success of the clean-energy transition depend on a thoughtful and cooperative approach to minerals supply.

This is a nice overview and I look forward to more details. It is interesting to me that nickel gets mentioned, but doesn't make it into the discussion like cobalt and lithium seem to always do. In my view, nickel is the worst of these. This is because its increased demand in renewables, especially EVs, accelerates strip-mining highly unique and biodiverse biota in Indonesia and the Philippines - plus the runoff goes onto coral reefs. For reasons I've laid out in my overview (Electric Vehicles: The Dirty Nickel Problem https://cleantechnica.com/2020/09/27/electric-vehicles-the-dirty-nickel-problem/), I think nickel should be just plain avoided. Or, if you have only 4 minutes (and like music!), there is this: So You Want An Electric Car? https://youtu.be/4sBN22UnAv8.

Nickel for alloys and batteries is preferentially sourced from sulfide ores because the conversion into high purity nickel compounds is less complex and costly than from laterites.

I don't think it necessary to avoid nickel use in batteries altogether though I do think cobalt should be avoided (and that will happen soon). The EV industry could supply all its nickel needs from sulfide orebodies for many decades to come. There are very large, though low grade, nickel sulfide or nickel/iron alloy orebodies in Viet Nam, Russia, Australia and Canada with production costs likely to be similar to laterite deposits. In Canada, which I am most familiar with having worked here as an exploration geologist, there are 5 deposits with drill defined resources that total about 12 million tonnes of contained nickel with room for further expansion. To put that in perspective total nickel demand for EVs in 2021 was in the order of 100,000 tonnes. These orebodies can be developed with potentially net zero carbon emissions using hydro electric power and by sequestering CO2 in the mine tailings.

Laterites tend to be higher grade but with high cost for metal recovery and as you point out use highly polluting processes. Lateritic nickel is produced mostly in the form of nickel pig iron which ends up as stainless steel. While laterite mines in production are mostly in the tropics there are some very large laterite deposits in arid climates in Australia. Two, Murrin Murrin and Ravensthorpe, are producing mines that have less negative impact than the mines in the tropics.

Why Tesla/Musk chose to pitch in with the mothballed New Caledonia laterite mine is a mystery given the major environmental and social problems that have beset that operation not to mention high costs. But Tesla's involvement so far does not seem to have involved any great commitment.

Europe and the US for decades have been outsourcing their mineral supplies and largely ignoring the negative environmental and social impacts that go with that policy. Poorer countries like the Philippines, Indonesia, New Caledonia, New Guinea and Madagascar, all with large laterite nickel mines, have paid a stiff price both in pollution and corruption of their political/governance systems.

If renewables are to be credible mining's social and environmental impacts have to be minimized. That's possible but it takes commitment, developed governance/regulation and money. I think eventually the car manufacturers will be forced to actively invest in upstream nickel and lithium supply.

These are good points and I agree that it would be better if EV manufacturers would confine their nickel to sulfide sources. However, 1) demand for nickel for EVs is fueling the construction of HPAL plants to provide nickel suitable for batteries (with even worse environmental problems than smelting), 2) China is stepping up the purification of laterite Ni pig-iron for EV use, and 3) EV demand will shift users which might have chosen (but not needed) sulfide nickel to laterite nickel, increasing environmental costs in laterite producing areas. So, that is why I would prefer to see no nickel in EV batteries.

This is a very good summary - I look forward to the next chapters. I'm not clear why the IEA left iron and aluminium out of their comparison of EV and ICE vehicle mineral inputs and not sure what minerals they are talking of when they say: “A typical electric car requires six times the mineral inputs of a conventional car”. This phrase has been seized upon by, on the one hand, the fossil fuel apologists and on the other the catastrophist greenie wing who paint EV and renewables tech generally as a threat almost on a par with fossil fuels.

A mid range Tesla weighs some 250 Kg. more than a similar sized ICE vehicle (Tesla 3 1750 kg, Toyota Camry 1495 kg) with most of the extra weight, and mineral content, in the battery. Aside from the engine, radiator and the exhaust system most of the other mineral contents are the same in the ICE V as in an EV. An internal combustion engine weighs about 130 kg (4 cyl) to 320 kg (V8, 6 cyl diesel), made up mostly of iron and aluminum with minor chromium, nickel and vanadium.

When looking at the clean energy transition we should also be considering other aspects of the energy and minerals demand spectrum. Vaclav Smil in his book "Growth" points out that the 72 million vehicles sold in 2015 had 180 times the mass but embodied only some 7 times the energy used to produce about 2.2 billion smart phones, tablets and notebooks that year. The phones, etc. have a short life of about 2-3 years so that the embodied energy use per year for portable electronic devices approaches that of vehicles. The recycling rate for consumer electronics, even though they contain many exotic minerals of high value, is abysmally low and for vehicles the recycling rate is quite high.

I have some comments on the 'dirty nickel' problem which I'll attach as a response to Cliff Rice's commentary below.

Excellent podcast, and I was delighted to see the informative graphs that helped explain things I missed. In a follow-up podcast, please let us about the lithium in the Salton Sea area in California, which is generating a lot of discussion now, both its potential and about the pollution and other hazards involved, especially to nearby communities.

I think one very important differences between this and oil is that for oil there isn't a replacement. If a country used a certain amout of oil to operate it would continue to require that amount for years, even decades.

While for these materials there are mostly credible replacements. For batteries, LFP contains only lithium unlike the (for now) more common NMC/NCA that contains more rare and problematic minerals. Sodium batteries aren't here yet, but look promising and contains no lithium.

While rare-earth metals can create some fantastic permanent magnet motors/generators there are other motors/generators that don't use them. These are used widely today, so they are competetive. Similarly some types of design use much less copper than others.

Our ability to move away from problematic minerals are much better than it ever was for oil. Of course that does not mean we will not have short term problems. But still. Much better.

I'm sure David has this on the agenda, but would be interested to learn more about what alternatives exist in non-battery industries to replace potentially expensive/difficult-to-get minerals with more numerous ones (as he already covered this for batteries in much greater detail). For example, SunDrive's recent solar panel made with copper instead of silver.

I' with you on LFP: So You Want An Electric Car? https://youtu.be/4sBN22UnAv8

I just read somewhere that there's a very significant amount of new aluminum required for the frames for all these solar panels. And given aluminum's high energy requirement for new creation that's something that will also increase CO2 a bunch till we green the power grids. How does that factor into the above ?

one fun factoid, it had a quote of 75% of all aluminum every made is still in use today, due to it's ridiculously low cost to recycle.

The shift to green energy would be much more environmentally friendly if we already had shifted to green energy! But every credible life cycle analysis I have seem still have solar and wind still come out as positive contribution.

Oh agreed. Though, I think it's only been recently that a solar panel actually went CO2 positive for it's full lifecycle? or maybe I'm just regurgitating the propaganda of the oil industry...haha even so, putting panels directly on the plants making panels seems like a great 'statement' to me

Extremely helpful. Thx.

One comment I’ve heard recently from people on the right is that there is child labor associated with mining and EVs. I assume this criticism is in bad faith, so maybe I shouldn’t even worry about responding, but my thought is, 1) this is already occurring for gas powered vehicles and 2) obviously this is something to address and make sure it doesn’t happen. Are there any other retorts ya’ll can think of that would be important for me to emphasize if I have this discussion with people?

"To [reach net zero by 2050/hold warming beneath 1.5°C], it must radically ramp up production of solar panels, wind turbines, batteries, electric vehicles (EVs), electrolyzers for hydrogen, and power lines."

David, it's already impossible hold warming beneath 1.5°C - or even 2.0°C - and there's plenty of evidence that "radically ramp[ing] up production of solar panels, wind turbines, batteries, electric vehicles (EVs), electrolyzers for hydrogen, and power lines" will make things even worse.

According to the "Grandfather of Climate Change Awareness", Columbia University climate scientist Dr. James Hansen, it isn't due to lack of minerals but misplaced faith in renewable energy:

"The underlying reason for the great overshoot of the 2°C scenario is failure of the world to develop a clean energy system for electricity. Instead, the West – or at least the liberal West – has adopted the fantasy of 100% renewable energy within decades, in which both nuclear power and fossil fuels are eliminated. Further, the West has instructed the developing world that it, too, must follow this fantasy. Consequently, President Clinton terminated research and development on nuclear power in the United States after his election in 1992. Germany, as the host nation for COP6 in Bonn in 2001, excluded nuclear power as a clean development mechanism under the Kyoto Protocol. Now, financing for fossil fuel or nuclear power plants is being denied to developing countries, even though the West used those energies to raise its own standards of living and continues to use those energies as needed to maintain living standards.

"The 100% renewables vision was spurred mainly by Amory Lovins, who correctly projected in the 1970s that energy efficiency would allow less energy use than predicted by the Energy Information Agency. However, his expectation that all fossil fuels, nuclear power and large hydro could be replaced by soft renewables is debunked by real world data. Real world utility experts conclude that renewable energies must be complemented by reliable baseload electricity generation available 24/7 – either fossil fuels or nuclear. For the sake of climate, the partner of renewables had better by nuclear power, not fossil fuels.

"The Big Climate Short has been handed to young people. They are inheriting an energy and climate system in which large climate change is now unavoidable. The United Nations and government leaders pretend that global warming, now at 1.2°C, can be curtailed with little additional warming. Capable scientists with an understanding of climate and energy know that this is pure, unadulterated bulls**t. Politicians who claim paltry successes while ignoring the elephants in the room must be called out. We have sold our young people short."

http://www.columbia.edu/~jeh1/mailings/2021/NovemberTUpdate+BigClimateShort.23December2021.pdf

Also, comparing LLNL's 2017 Energy Flow Chart with your 2020 update shows that in three years natural gas consumption for electricity had increased by 31%:

https://flowcharts.llnl.gov/content/assets/images/charts/Energy/ENERGY_2017_USA.png

An environmental boon? No, the "clean energy transition" is an unfolding environmental disaster.

So what is your argument? That it shouldn’t happen? That we need nuclear and renewables? If you’re claiming disaster either way, just trying to clarify what your position is on what to do about this.

My argument is to heed the advice of climate experts - not venture capitalists of any persuasion, nor the investment banks that profit from enriching them, nor the multitudinous dot-coms that sell advertising to them, nor their suppliers, promoters, or consultants. They believe "nuclear power paves the only viable path forward on climate change."

https://www.theguardian.com/environment/2015/dec/03/nuclear-power-paves-the-only-viable-path-forward-on-climate-change

That means nuclear power - not solar, wind, wave energy, hydroelectric, nor geothermal - is priority #1, the basis, the ground floor. That's where funding goes to first, not last.

Ok thank you for the clarification. I just trust that Volts (that’s what I call Mr. Roberts bc when I first heard the pod And he said “this is volts” I immediately assumed it was his moniker) has looked into all of this. I’m assuming he is heeding the advice of climate experts.

Jeremy, WADR to Volts: many well-meaning people who are concerned about climate change, I feel, are being deceived about what our prospects are for limiting CO2 concentration in the atmosphere.

No one can argue that wind and solar have made gains in the last decade. But no one can argue that both remain inherently limited by the restrictions imposed on them by night and weather, as well. Solar will never generate electricity at night; wind turbines will never generate electricity when the wind isn't blowing. And electrical energy doesn't sit in wires, waiting to be used - it must be generated, in real time, to meet demand.

Those who view batteries as a potential way to overcome these limitations don't understand how much electricity is required to feed the massive appetite of consumers. To power California for one day with batteries would require an investment of over $1 trillion - more than four times California's annual budget. Without that much money to spend on batteries, and re-spend every 7-10 years as they wear out, we need some kind of baseload energy to generate electricity to the grid, in real time, when renewables are unavailable.

Nuclear is the only source that can do it reliably and with no CO2 emissions. If nuclear is too expensive in some locations, we must reduce its cost. Those are really our only options.

Solar and batteries can be deployed now at scale with a lot of unused pathways to make them proliferate and universal. For instance, an Eisenhower Interstate-esque 90% subsidy on installed cost of panels and batteries would cause a massive rapid deployment on commercial and residential installations (with bylaws blocking price gouging on the items and labor, with an inflation allowance, index the costs to 2019). Right now you don't have America's commercial parking lots getting solar canopies, nor big box stores installing batteries, but if the installed cost were 90% subsidized? nearly universal adoption within a year or two.

Nuclear is important and essential but in the United States takes about 35 years from proposal to turning on one nuclear reactors 1GW of power (1 proposal yields 15 years of fighting, 5 years of bid/design, 14 years of construction and 1 year of approvals). The cumulative emissions of delaying renewables while waiting 35 years for that nuclear aren't acceptable--particularly when globally, 160 GW of renewables were installed last year, and likely in less than ten years globally will be installing 2TW or more of renewables per year. if the scale and installation keeps increasing after that, we could have 50TW installed in less than 20 years. if it flatlines at 2TW of renewables every year, we'd still get to 50 TW before the 35 years it takes to build one 1GW nuclear reactor in the united states.

The other downside risk to nuclear is the human factor. it's dangerous. and we have one political party devoted to the ideology that all regulations are evil, no matter what they protect us from. How does the risks of nuclear play out when one political party (and self-interested capitalists) are devoted to stripping away regulations that keep nuclear viable and safe for ideological purity (and short term profits)?

for example, the very human motives of "profit above all else" that lead to

falsifying regulatory x-rays of welds in a reactor, as seen in the movie Silkwood. Nuclear power is pretty amazing and generally safe, but until we change human nature, there will still be innumerable people enthusiastically and elaborately making nuclear dangerous if they think it will increase a dividend by one penny.

And frankly republicans anti-regulatory ideology makes new/more nuclear potentially enacted under their regimes downright terrifying in many

respects than it would have been thirty-five years ago.

"Solar and batteries can be deployed now at scale with a lot of unused pathways to make them proliferate and universal. For instance, an Eisenhower Interstate-esque 90% subsidy on installed cost of panels and batteries would cause a massive rapid deployment on commercial and residential installations..."

Unsupportable conjecture.

"Nuclear is important and essential but in the United States takes about 35 years from proposal to turning on one nuclear reactors 1GW of power (1 proposal yields 15 years of fighting, 5 years of bid/design, 14 years of construction and 1 year of approvals)."

Georgia Power began construction on Units 3-4 at Plant Vogtle in 2013; they will go online in 2023. When they do, the plant will be generating more clean electricity than all renewables east of the Mississippi combined - in any weather, or time of day.

"...likely in less than ten years globally will be installing 2TW or more of renewables per year."

Likely? Basing climate policy on guesswork, in 2022, would be the height of irresponsibility.

"The other downside risk to nuclear is the human factor. it's dangerous. and we have one political party devoted to the ideology that all regulations are evil, no matter what they protect us from."

The dangers of nuclear power are highly exaggerated. Per unit of power, nuclear is the safest way to generate dispatchable electricity on a grid - by far.

https://ourworldindata.org/safest-sources-of-energy

You won't get any disagreement from me about the evils of Republicanism, or Fascism, or whatever it's called today. Refreshing, however, that support for nuclear energy is bi-partisan - that means legislation with the potential of becoming law.

"...that lead to falsifying regulatory x-rays of welds in a reactor, as seen in the movie Silkwood."

The Cimarron Fuel Fabrication Site featured in the film Silkwood was closed 47 years ago. To compare fuel fabrication and safety of 47 years ago to today's would be equivalent to comparing solar panels manufactured in 1975, to those produced now. No comparison.

The world’s economy & cultures are saturated with fossil fuels. Adverse climate effects are bad enough, but the constantly gyrating instability of energy pricing is in itself a kind of insecurity inducing social poison, exploited by BigOil to make money & justified by the rationale that this is simply how capital free markets work. Energy market-makers & manipulators like Enron & cartels make money from both real and illusory short-term scarcity; for them, scarcity is a permanently exploitable feature, not a bug. It does appear, and we can only hope, that the shift to widely distributed, abundant, safe, reliable, inexpensive renewable energy will at some point, perhaps by 2050, result in a significant reduction in the levels of social & economic disruption & anxiety inherent in our current fossil fuel dependent economy. RE: Minerals, It’s interesting to see that existing energy producing geothermal wells are now being considered as lithium sources.

I have two concerns: 1. Mining is the dirtiest of all industries, and one can include fossil fuel extraction in this since it is actually a form of mining. Currently in the U.S., the environmental pollution resulting from mining appears to be poorly regulated. How is the world going to deal with the environmental impacts resulting from the mining of minerals that are needed for renewable energy? 2. What is the lifetime of renewable energy infrastructure? How long do wind turbines, solar panels, and batteries for electric vehicles last before they must be replaced? Will the supply of minerals crucial for renewable energy infrastructure be sufficient over the long term? I'm not against the transition to renewable energy, but I think we need to analyze in great detail what the environmental costs will be and avoid unpleasant surprises down the road! I think there is too much wishful thinking about renewable energy at the moment.