Thread

1/ Much is said about paper hands who sell at the first sign of weakness.

But how long is someone willing to wait.....to realize losses? 👀

Let me show you some charts that you've never seen before, courtesy of the WIZARDS on the @glassnode data science team. 🧵👇

But how long is someone willing to wait.....to realize losses? 👀

Let me show you some charts that you've never seen before, courtesy of the WIZARDS on the @glassnode data science team. 🧵👇

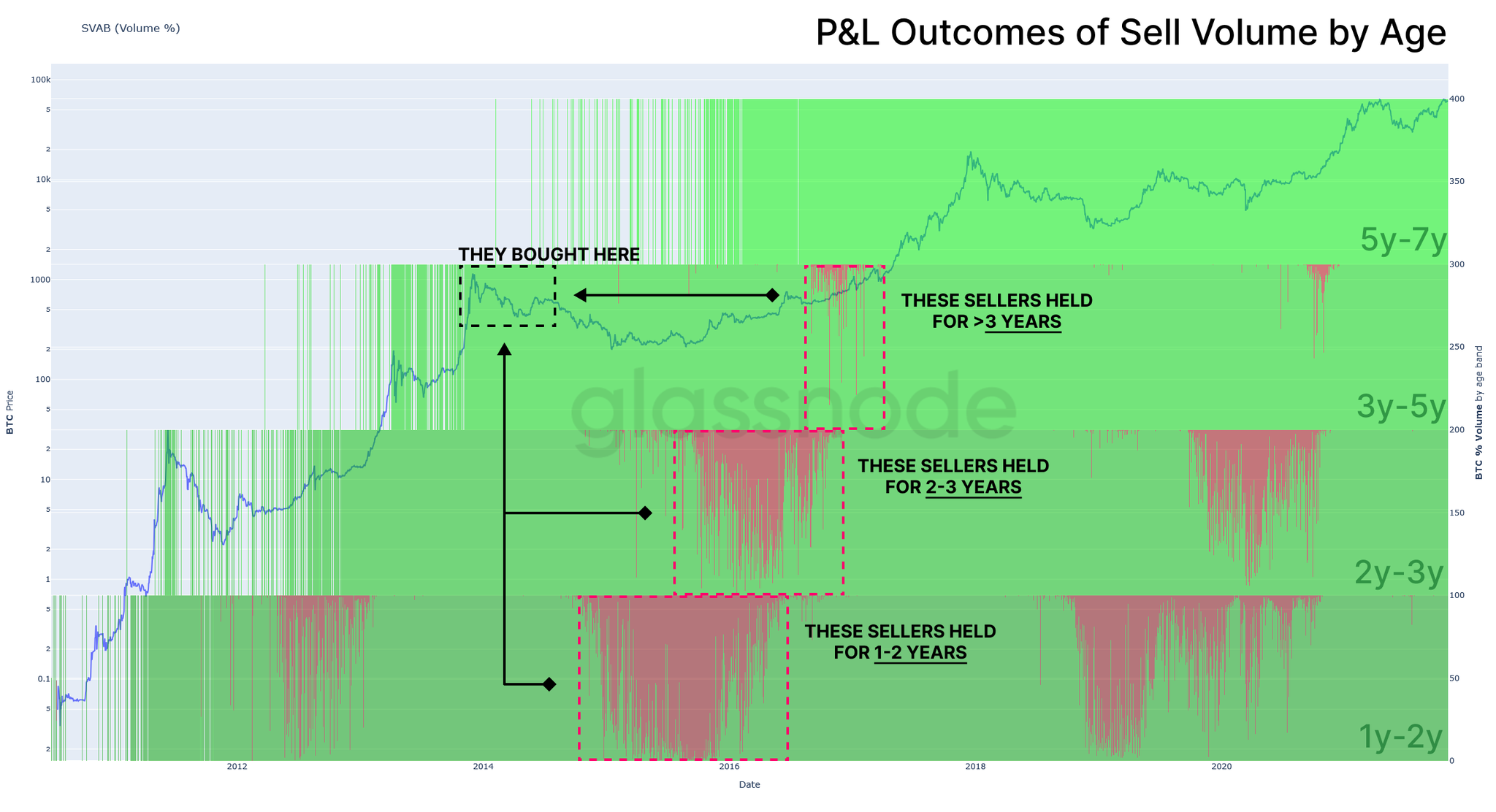

2/ This is daily spent coin volume by age band, colored by P&L outcome. Focusing on the 2014-2017 market.

🔴Red indicates spenders *in loss* that have coins aged the denoted time.

People sat on #BTC for OVER THREE YEARS just to sell at a loss when price neared their cost basis.

🔴Red indicates spenders *in loss* that have coins aged the denoted time.

People sat on #BTC for OVER THREE YEARS just to sell at a loss when price neared their cost basis.

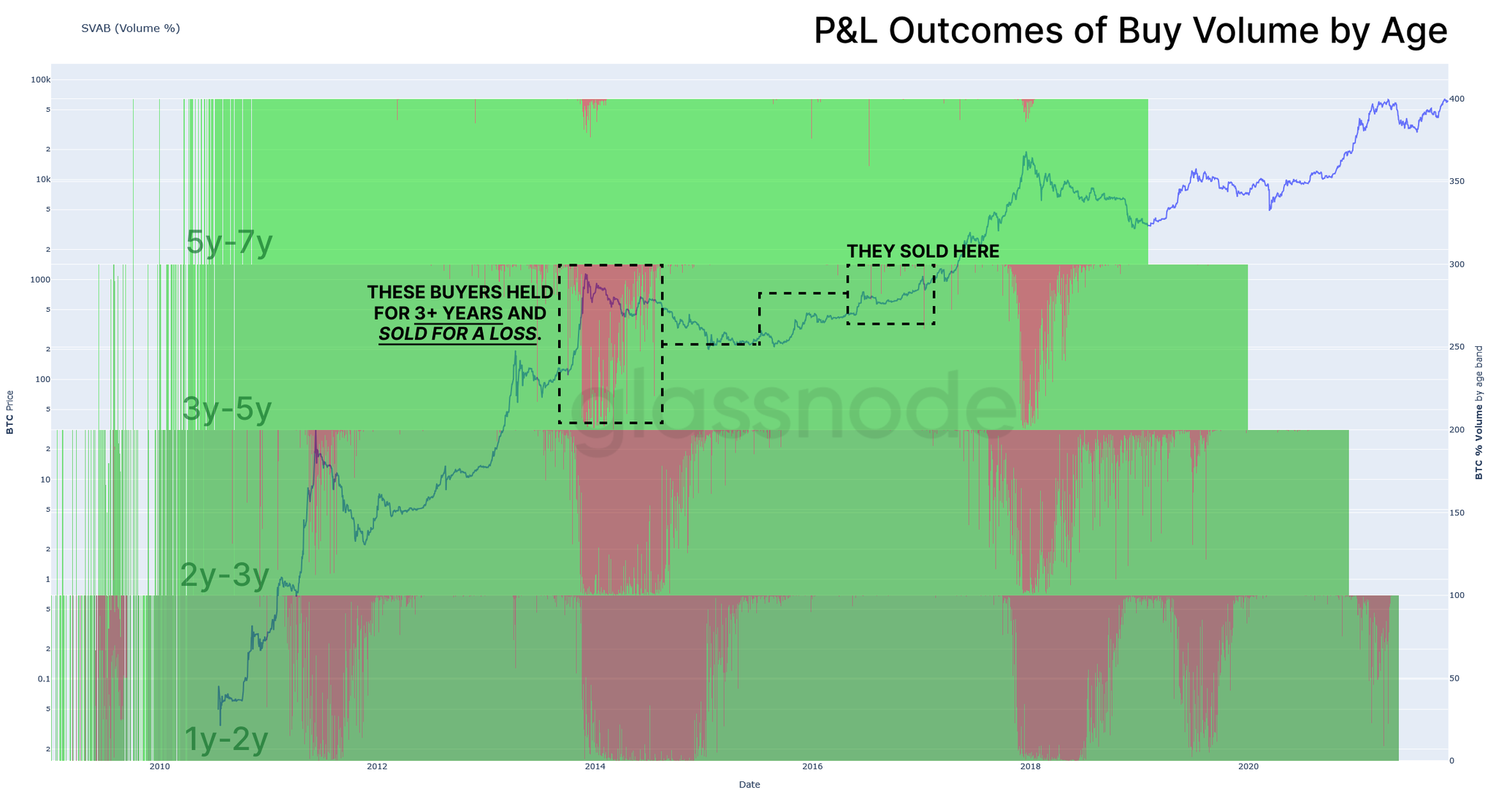

3/ Same chart, Spent Volume Age Bands colored by P&L, focused on 2017-2020.

Again, a bunch of people bought the top in 2017 and held for OVER THREE YEARS just to sell at a loss *in a bull market*.

Every one of these stone handed loss takers saw price rip after they bailed.

Again, a bunch of people bought the top in 2017 and held for OVER THREE YEARS just to sell at a loss *in a bull market*.

Every one of these stone handed loss takers saw price rip after they bailed.

4/ Same data in reverse- this is BUYING volume colored by their *eventual sale P&L*.

This shows where coins sold in loss originated from.

Look how much volume bought at the 2014 top was held the entire bear, only to be sold for a loss YEARS later into market strength.

This shows where coins sold in loss originated from.

Look how much volume bought at the 2014 top was held the entire bear, only to be sold for a loss YEARS later into market strength.

5/ Think about the gut wrenching pain:

You buy the 2017 top. You hold #BTC in a loss for multiple years.

*Finally* it comes back to your entry price, and you get out "scratch" and wipe the sweat from your brow.

Then, price rips 15%. Then 40%. Then 100%.

ABSOLUTELY GUTTED.

You buy the 2017 top. You hold #BTC in a loss for multiple years.

*Finally* it comes back to your entry price, and you get out "scratch" and wipe the sweat from your brow.

Then, price rips 15%. Then 40%. Then 100%.

ABSOLUTELY GUTTED.

6/ What are my key learnings here?

1. Never underestimate another trader's willingness to endure pain.

2. Humans have a natural attraction to loss.

3. And, I guess, it's obvious people will buy and hold something for years without bothering to learn more about it.

1. Never underestimate another trader's willingness to endure pain.

2. Humans have a natural attraction to loss.

3. And, I guess, it's obvious people will buy and hold something for years without bothering to learn more about it.