Thread

THREAD: Here's why sanctioning the Central Bank of Russia could prove devastating - the true "nuclear" option in the West's financial arsenal. Russia currently holds about $640 billion in reserves. About 32% held in euros, 22% in gold, 16% in dollars, and 13% in Yuan. 1/

Most of that gold is held domestically and beyond the reach of sanctions. But about $300 billion in reserves are held abroad. Freezing those will prevent the Bank of Russia from using them for things like currency interventions or transfers to the Russian Treasury to spend. 2/

We're already seeing the ruble fall to its lowest levels ever as holders of rubles rush to exchange them for other currencies they think are safer stores of wealth. This is typical in crises - people trust dollars more than rubles to hold value. 3/ www.xe.com/currencycharts/?from=USD&to=RUB&view=10Y

We saw this dynamic during Russia's August 1998 financial crisis, again in 2014, and we're seeing it now. 4/ www.themoscowtimes.com/2014/10/23/is-russia-heading-for-a-new-1998-crisis-a40703

Currencies are bought and sold on international foreign exchange markets. Like any traded good, their price (or exchange rate) is a function of supply and demand. Demand for the ruble is plummeting: people are selling them in exchange for dollars/euros. 5/

This means that the market is being flooded with rubles that nobody really wants, so supply is increasing. Falling demand and rising supply means the "price" of the ruble is dropping, or weakening. 6/

A crashing ruble is bad for consumers: they get fewer imported goods for their rubles AND fewer domestic goods (reduced purchasing power). Put another way, it takes more rubles to buy the same stuff as before. That's called inflation, and it can get quite severe. 7/

High inflation is generally bad for economic growth, and hyperinflation is historically associated with severe recession/depression. That's bad for ordinary folks and, say, governments who are waging costly wars with their neighbors. 8/ www.frbsf.org/education/publications/doctor-econ/1998/june/inflation-economic-growth/

This is why central banks often intervene in currency markets to stabilize their currency: spend your reserves (dollars, euros, gold, etc) and buy up rubles to reduce the supply and prop up the exchange rate. 9/

But what happens when you burn through your reserves? You can't support your exchange rate by buying up excess rubles, and the currency crashes. That's what we saw in Russia in 1998, and that's what precipitated a major economic meltdown. 10/

What happens if you have reserves but you can't access most of them for currency interventions? Or you're not allowed to exchange your dollars and euros for rubles? That's what sanctioning the Bank of Russia could do, and it would have the same effect: unchecked freefall. 11/

Rubles could (in theory) become close to worthless, with ordinary citizens conducting exchange in dollars. That would have to be on the black market, since it's technically illegal to pay for things with dollars/euros directly. Dollars will be scarce & precious on the street. 12/

But many Russians will probably continue to get paid in rubles, which won't be worth much for basic necessities. Remember those pictures from Weimar Germany of folks with carts full of worthless cash? It wouldn't look like that today, but the effect could be the same. 13/

This is just a *possible* scenario, and there are lots of factors that could influence things. China's willingness to exchange/transact in rubles might be one of them. Crypto is another. But until you can buy shashlyk on Arbat with bitcoin, you have to exchange it. 14/

I'm just a political scientist. But below are some statements from economists on what sanctioning the Bank of Russia could lead to. Source of these quotes is this article: /15 www.yahoo.com/now/u-weighs-sanctions-russia-central-140320557.html

“The speed and unity to take this unprecedented financial action will give Putin pause,” said Josh Lipsky of the Atlantic Council. “The SWIFT move was largely expected but striking at the Central Bank will reverberate in Moscow and beyond.” 16/

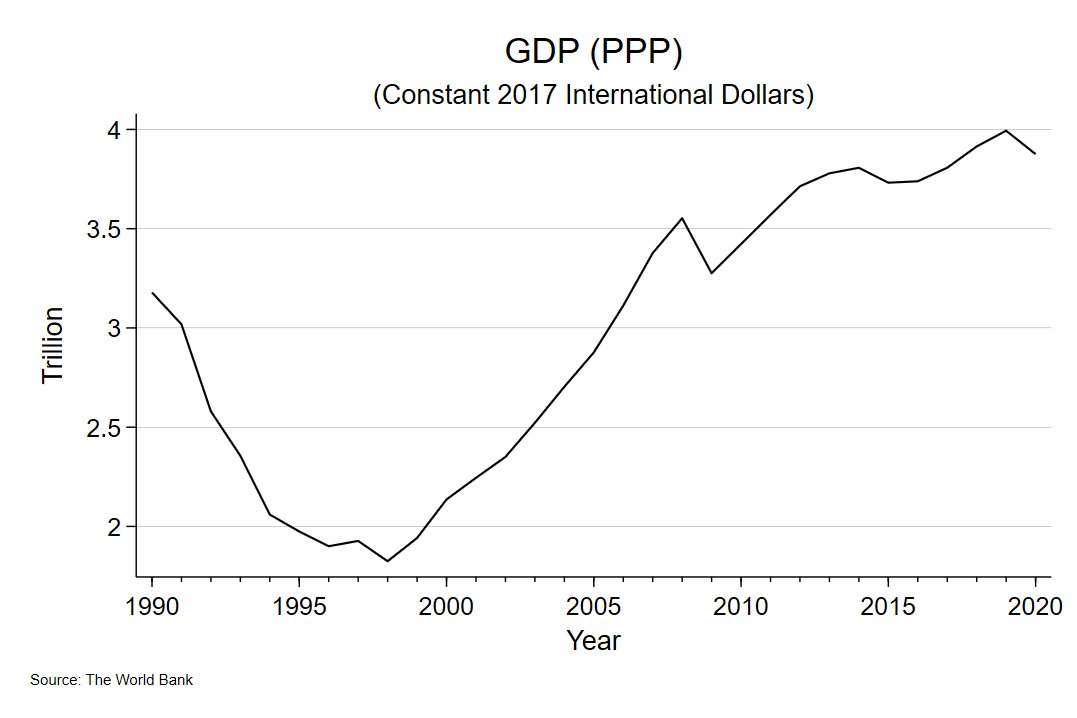

"'Sanctioning Russia’s central bank is likely to have a dramatic effect on the Russian economy and its banking system, similar to what we saw in 1991,' said Elina Ribakova, deputy chief economist for the Institute of International Finance." Remember what that looked like? 17/

Ribakova continues, "This would likely lead to massive bank runs and dollarization, with a sharp sell-off, drain on reserves -- and, possibly, a full-on collapse of Russia’s financial system." 18/

I will emphasize again that there are a lot of unknowns, contingencies, and confounding factors that make it hard to predict what will happen. But we've only ever sanctioned the central banks of Iran, Venezuela, and North Korea. So this *could* be a Really. Big. Deal. 19/

In conclusion, Слава Україні! Героям слава! 🇺🇦 20/END