Thread

Tom Engle is an incredible investor.

He worked for 9 years, quit, and has lived off of his portfolio for 40 years.

How? His BRILLIANT cash management strategy.

Here's how it works:

He worked for 9 years, quit, and has lived off of his portfolio for 40 years.

How? His BRILLIANT cash management strategy.

Here's how it works:

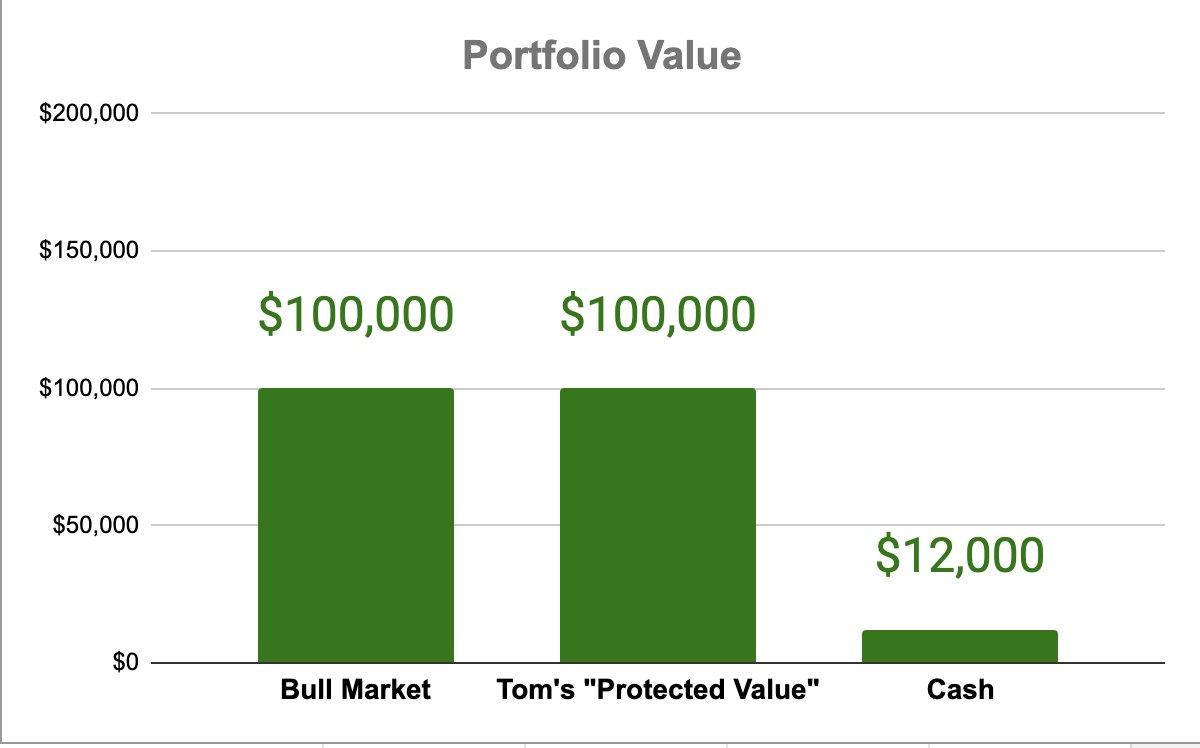

Let's say Tom's portfolio is worth $100,000 in the middle of a bull market.

Tom is happy with this number and wants to protect it.

He mentally calls this $100,000 his "protected value."

All his cash management decisions are based on this number.

Tom is happy with this number and wants to protect it.

He mentally calls this $100,000 his "protected value."

All his cash management decisions are based on this number.

Tom always keeps an eye on the macro and has an idea of how the market is:

▪️Under-valued

▪️Fairly-valued

▪️Over-valued

Tom keeps ~12% of his "protected value" in cash in a fairly-valued market

That's $12,000

▪️Under-valued

▪️Fairly-valued

▪️Over-valued

Tom keeps ~12% of his "protected value" in cash in a fairly-valued market

That's $12,000

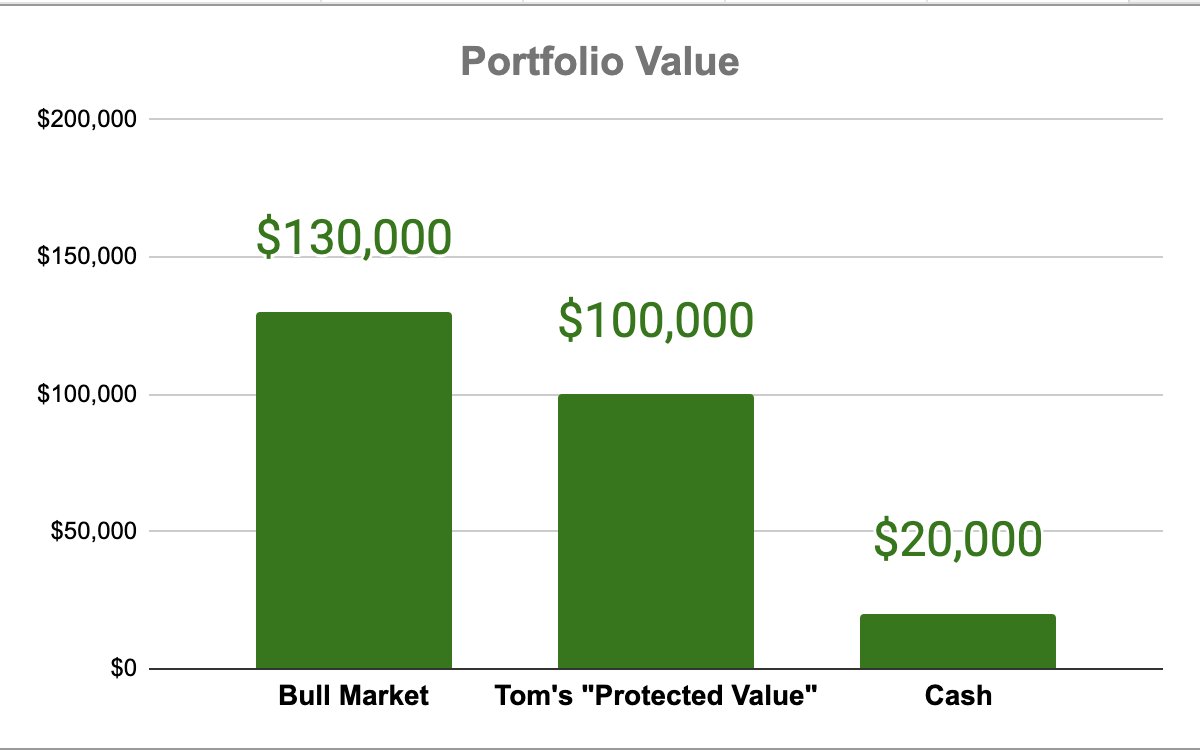

Let's say the bull market continues.

Tom's portfolio continues to grow.

He trims some of his holdings as valuations expand and his net worth grows.

Tom's portfolio continues to grow.

He trims some of his holdings as valuations expand and his net worth grows.

Let's say his portfolio grows to $130,000

Tom continues to trim, maxing out at 20% of the protected value in cash ($20,000)

At this point, Tom usually can't find any stocks trading at bargain prices.

Tom continues to trim, maxing out at 20% of the protected value in cash ($20,000)

At this point, Tom usually can't find any stocks trading at bargain prices.

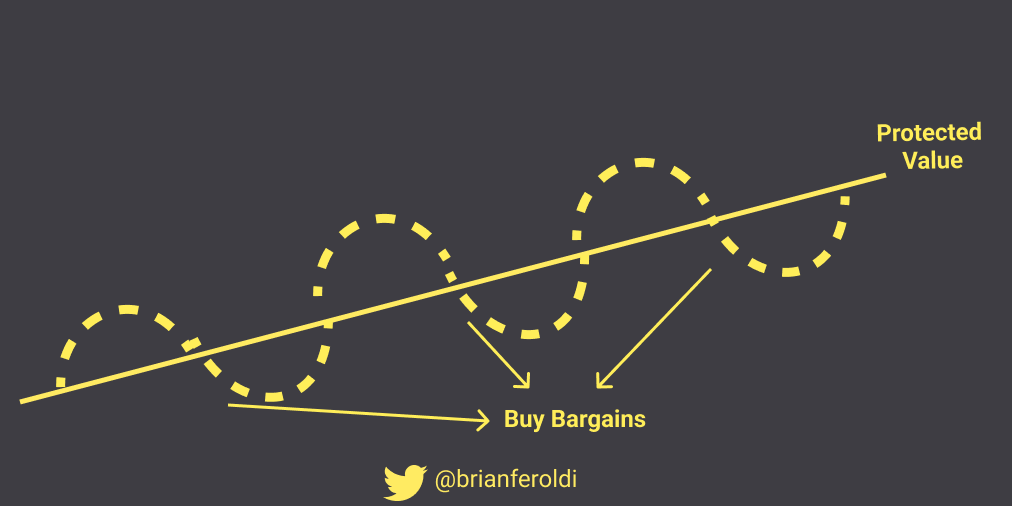

The bull market eventually ends. Prices start to decline.

Tom slowly buys his favorite stocks at "better and better valuations" as prices fall and valuations begin to favor buyers.

Tom slowly buys his favorite stocks at "better and better valuations" as prices fall and valuations begin to favor buyers.

Tom continues to buy as prices fall and valuations improve.

Tom is OK with his portfolio value falling, even below his "protected value"

If that happens, he knows he's buying TONS of bargains

Tom is OK with his portfolio value falling, even below his "protected value"

If that happens, he knows he's buying TONS of bargains

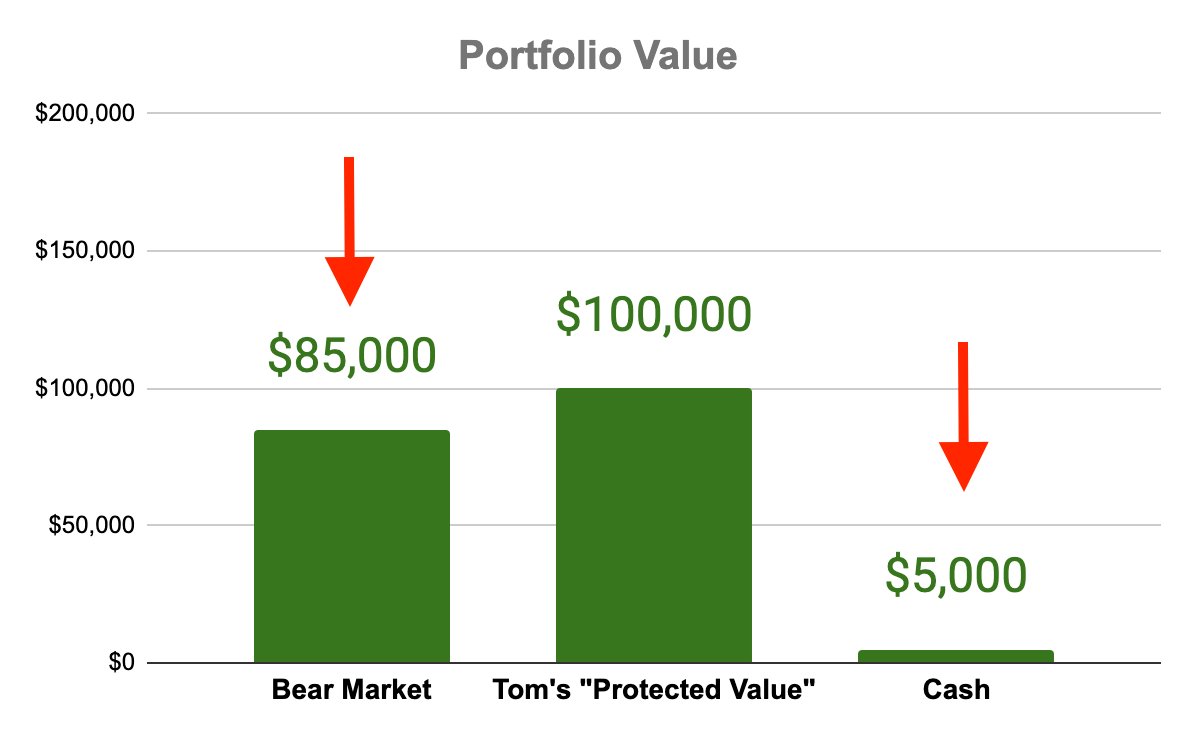

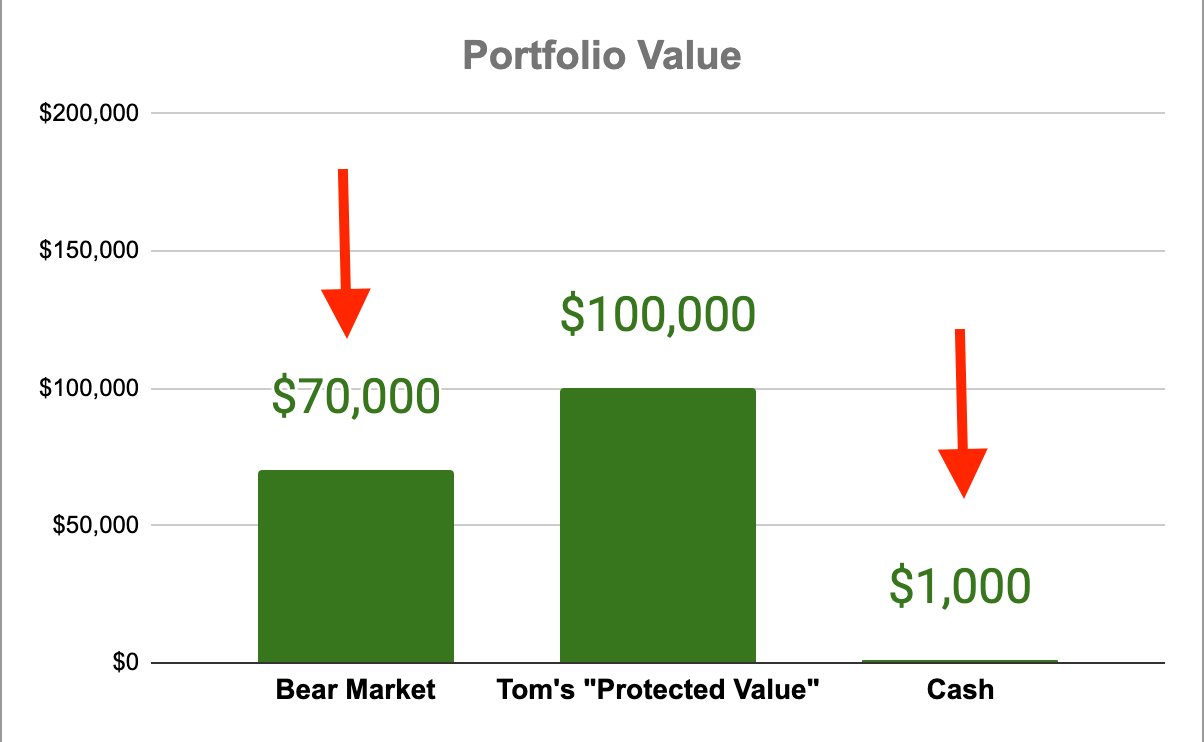

Let's say the bear market is really bad, like now.

Tom's portfolio falls to $70,000, well below his $100,000 protected value.

At that point, HUGE bargains are everywhere, and his cash position drops to just 1% of the protected value from all the buying

Tom's portfolio falls to $70,000, well below his $100,000 protected value.

At that point, HUGE bargains are everywhere, and his cash position drops to just 1% of the protected value from all the buying

Eventually, the bear market ends, and the next bull market starts.

Tom's returns skyrocket, especially from his bargain purchases when his portfolio was below $100,000

He slowly trims on the way up to rebuild his cash position.

Tom's returns skyrocket, especially from his bargain purchases when his portfolio was below $100,000

He slowly trims on the way up to rebuild his cash position.

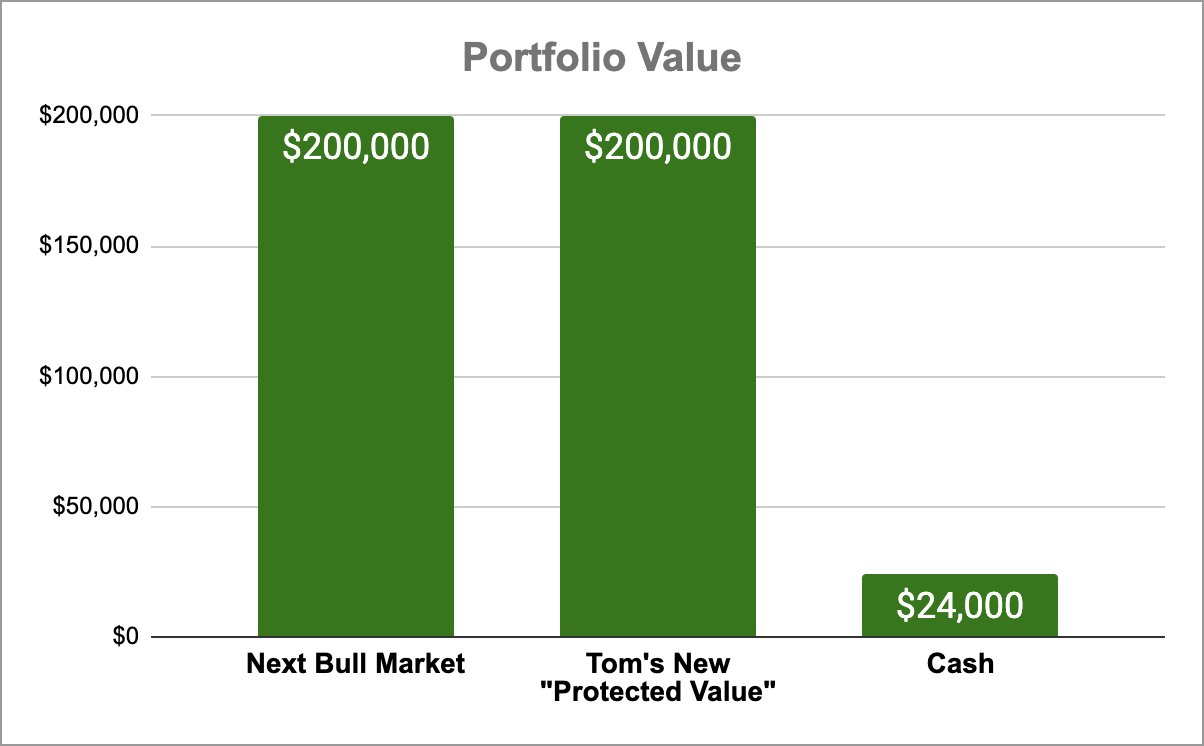

Within 3 to 5 years, his portfolio doubles to $200,000, powered by his bargain buying during the last bear market

He's happy with this number, so it becomes his new "protected value"

His cash balance target is now $24,000 -- 12% of the $200,000

He's happy with this number, so it becomes his new "protected value"

His cash balance target is now $24,000 -- 12% of the $200,000

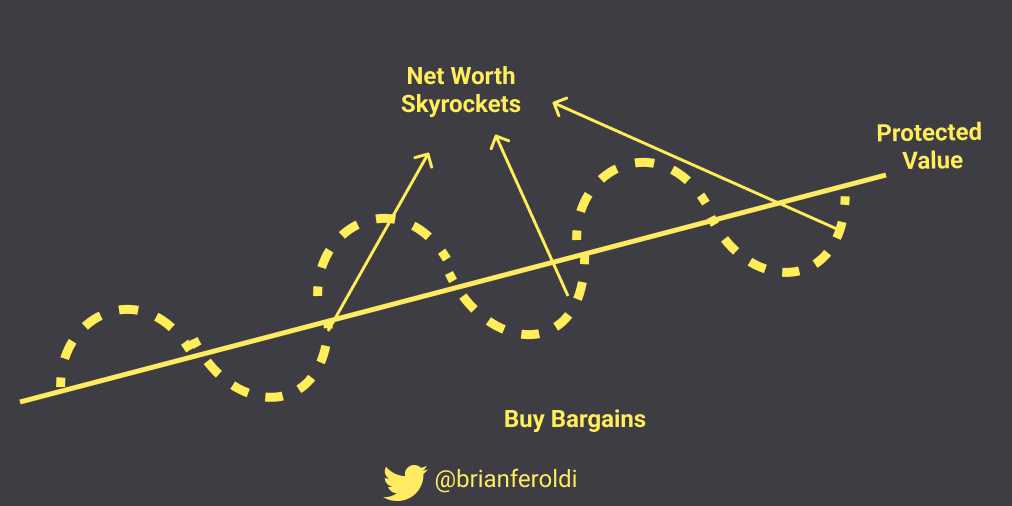

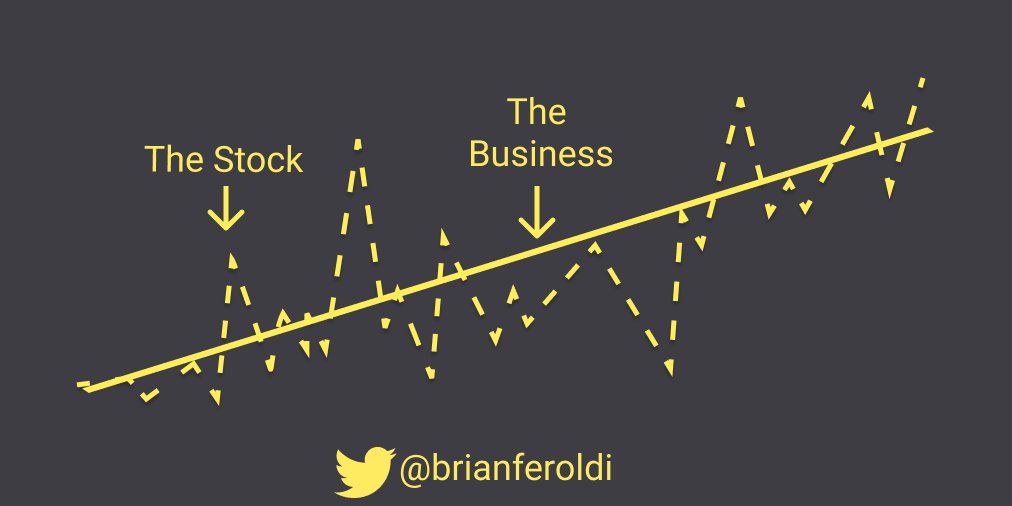

Tom rinses and repeats for each market cycle.

He builds cash when valuations are high.

He buys bargains when valuations are low.

The protected value moves steadily higher over time.

He builds cash when valuations are high.

He buys bargains when valuations are low.

The protected value moves steadily higher over time.

Tom likes this strategy because it allows his cash position to "grow at the same rate as my portfolio."

The example above is an extreme bull/bear market.

Tom's cash balance has only been 1% once (Feb 2009).

And it's rare for it to be above 20%

Tom usually keeps between 5% and 15% of the projected value in cash during "normal" market fluctuations.

Tom's cash balance has only been 1% once (Feb 2009).

And it's rare for it to be above 20%

Tom usually keeps between 5% and 15% of the projected value in cash during "normal" market fluctuations.

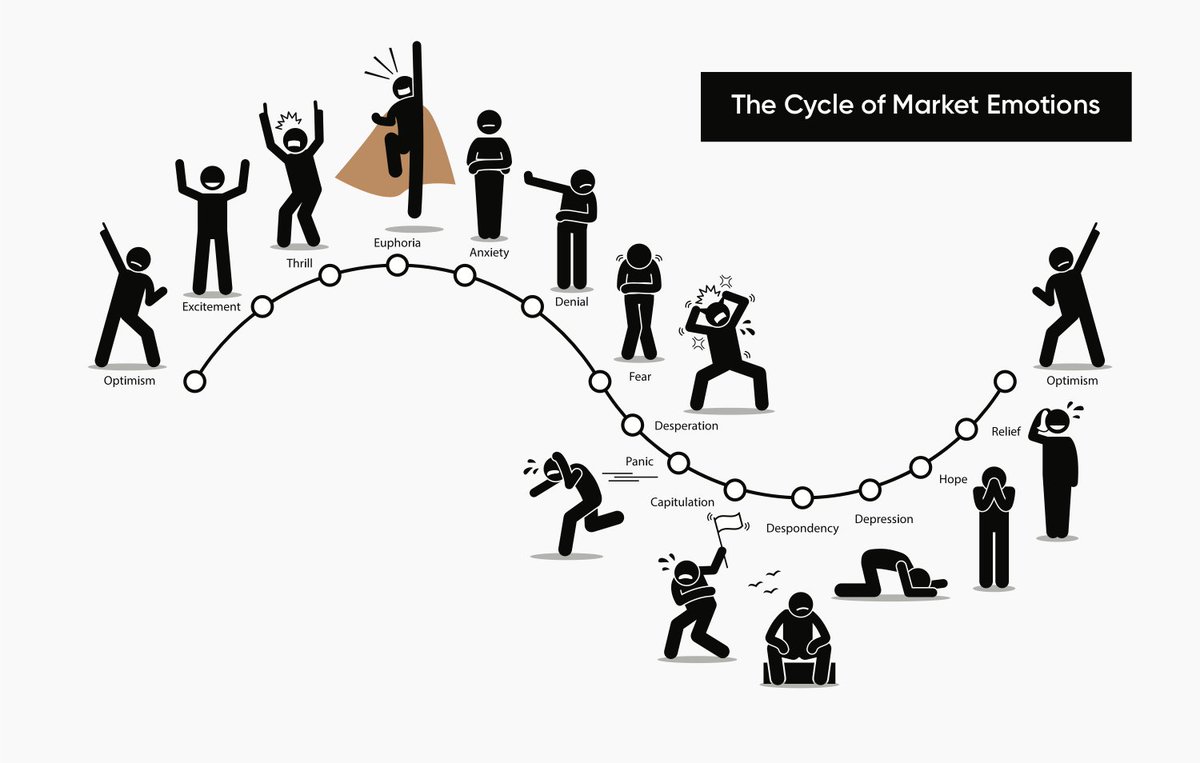

I love the idea of a "protected value"

It gives Tom a firm target to focus his cash value around.

Focusing on the "protected value" makes it easier to handle the cycle of market emotions.

It gives Tom a firm target to focus his cash value around.

Focusing on the "protected value" makes it easier to handle the cycle of market emotions.

Like any investing strategy, the theory is easy to understand.

Putting the strategy into practice is the HARD part.

Still, I find tremendous value in studying the strategies of successful investors.

Putting the strategy into practice is the HARD part.

Still, I find tremendous value in studying the strategies of successful investors.

Like this thread?

Follow me @BrianFeroldi.

I demystify finance with daily tweets and one thread a week.

Follow me @BrianFeroldi.

I demystify finance with daily tweets and one thread a week.

Like this thread? You'll love my free Wednesday newsletter:

I share:

▪️ One simple graphic (like this)

▪️ One piece of timeless content

▪️ One Twitter thread

▪️ One resource

▪️ One quote

Interested? Join 40,000+ others:

mindset.brianferoldi.com

I share:

▪️ One simple graphic (like this)

▪️ One piece of timeless content

▪️ One Twitter thread

▪️ One resource

▪️ One quote

Interested? Join 40,000+ others:

mindset.brianferoldi.com

Want to learn more about Tom's investing style?

Read this thread next about how Tom builds positions at "better and better value points."

Read this thread next about how Tom builds positions at "better and better value points."