Thread

1/9

Yesterday I went over the RRP program. In today's thread, how does it relate to QT.

Bottom line, the Fed is hoping QT will cause short rates to rise, "encouraging" RRP to flow back into banks and "offset" the QT liquidity drain.

That's the theory

Yesterday I went over the RRP program. In today's thread, how does it relate to QT.

Bottom line, the Fed is hoping QT will cause short rates to rise, "encouraging" RRP to flow back into banks and "offset" the QT liquidity drain.

That's the theory

2/9

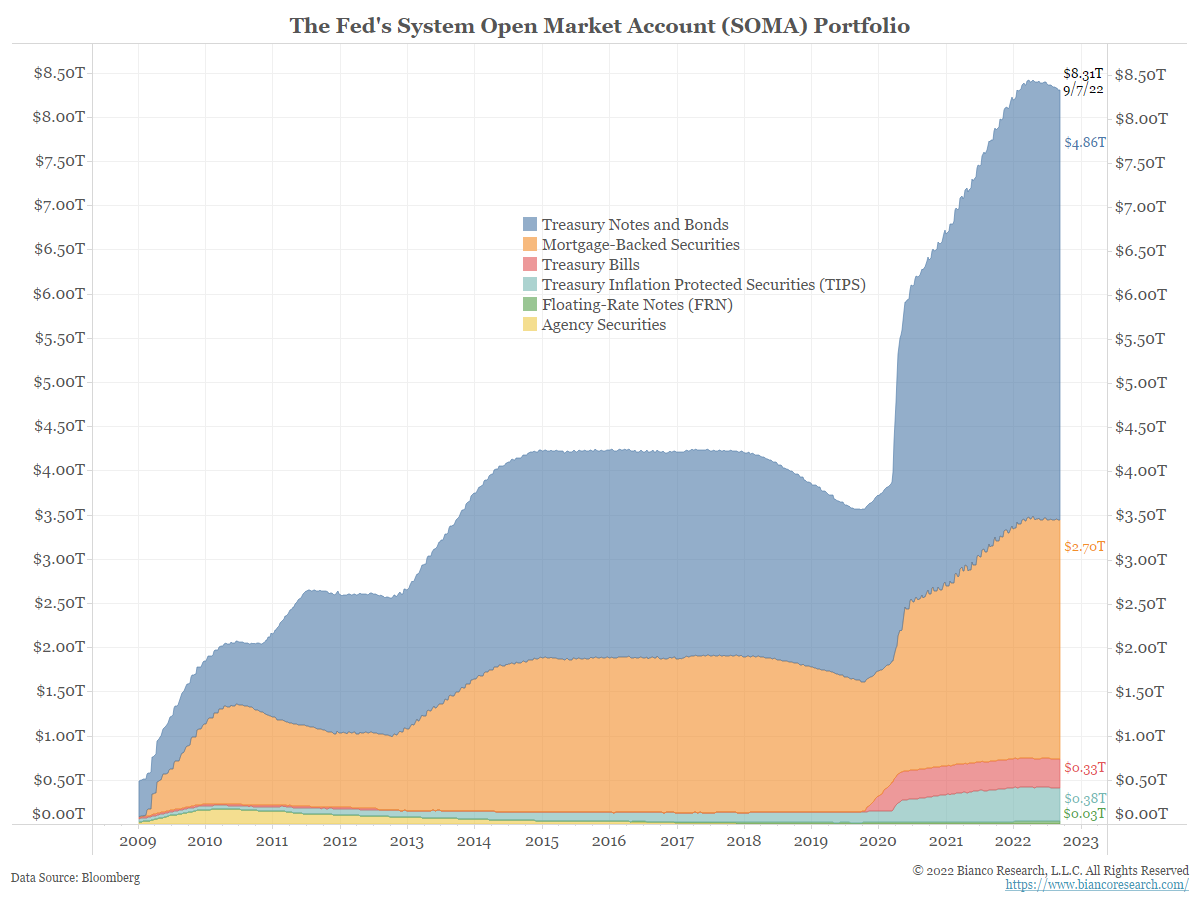

First, what is QE? The Fed creates money (also known as "printing"). How?

The Fed calls a bank and buy bonds from them. How does the Fed pay for the bonds?

Simple, if the Fed buys $10M of bonds from a bank, they change their reserve account to increase it by $10M.

First, what is QE? The Fed creates money (also known as "printing"). How?

The Fed calls a bank and buy bonds from them. How does the Fed pay for the bonds?

Simple, if the Fed buys $10M of bonds from a bank, they change their reserve account to increase it by $10M.

3/9

The great economist Paul Kasriel calls the Fed/central banks legal counterfeiters.

If a commercial bank does it, everyone goes to jail, if a central bank does it, it's called "monetary policy."

The great economist Paul Kasriel calls the Fed/central banks legal counterfeiters.

If a commercial bank does it, everyone goes to jail, if a central bank does it, it's called "monetary policy."

4/9

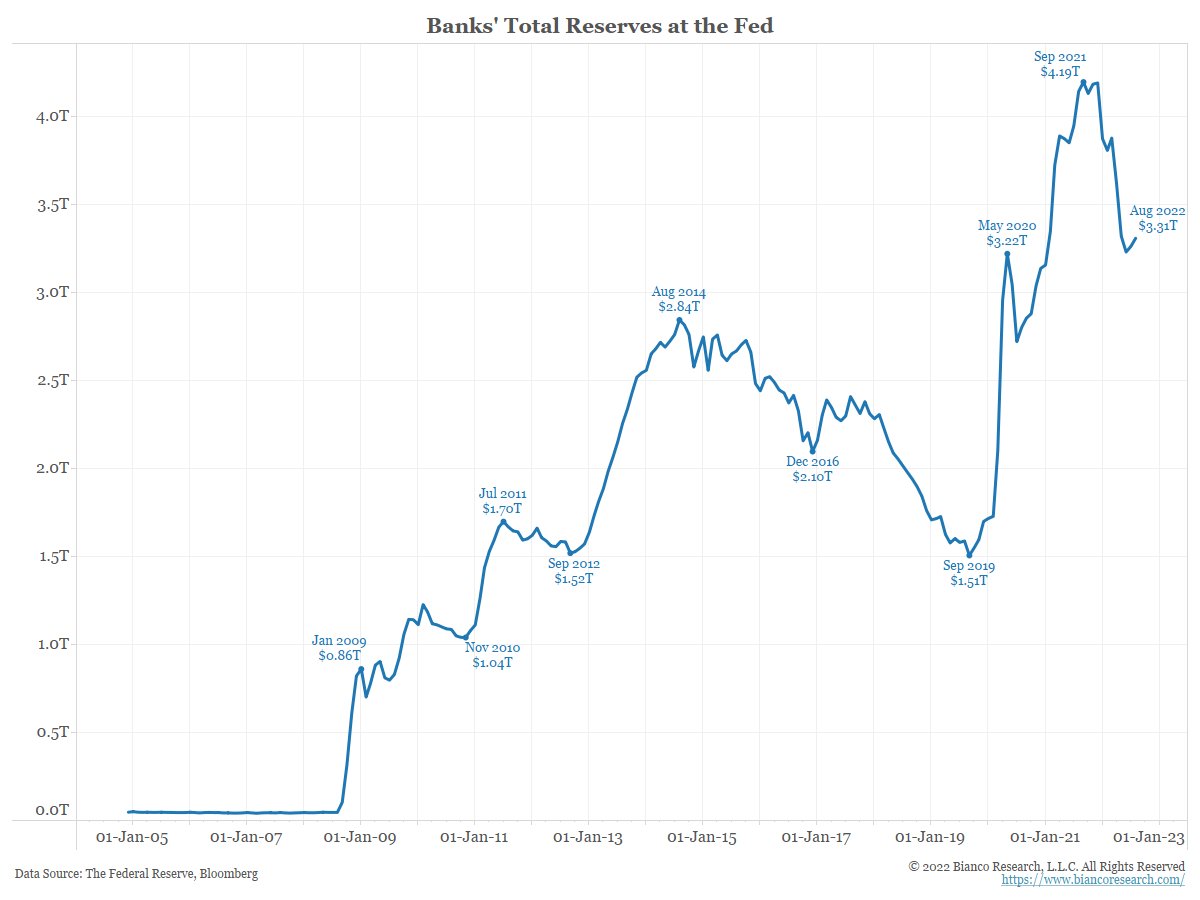

As a consequence of 13 years of QE, the banks are massively overserved with trillions in bank reserves, more than they need.

As a consequence of 13 years of QE, the banks are massively overserved with trillions in bank reserves, more than they need.

5/9

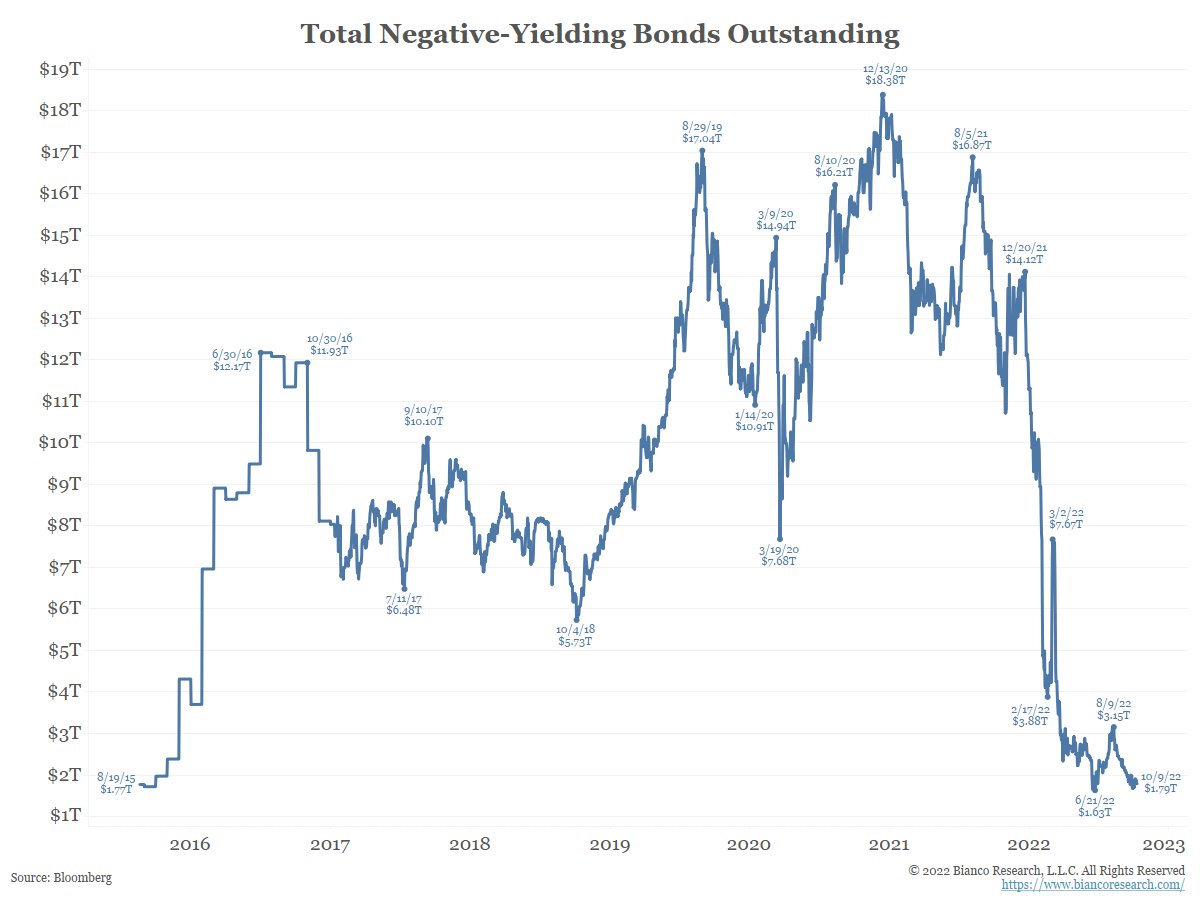

The buying of bonds with "printed" money has pushed rates so low, it results in a massive distortion of the bonds market, known as negative interest rates.

(Currently only Japan has negative rates)

The buying of bonds with "printed" money has pushed rates so low, it results in a massive distortion of the bonds market, known as negative interest rates.

(Currently only Japan has negative rates)

6/9

So, the Fed sees an opportunity to remove these excess reserves. So, they are hiking rates and doing QT.

How does the Fed do QT?

(Will only focus on the $60B/M in Tsy QT, the $35B/M in MBS is a bit more complicated as MBS values go up and down, Tsy values are constant)

So, the Fed sees an opportunity to remove these excess reserves. So, they are hiking rates and doing QT.

How does the Fed do QT?

(Will only focus on the $60B/M in Tsy QT, the $35B/M in MBS is a bit more complicated as MBS values go up and down, Tsy values are constant)

7/9

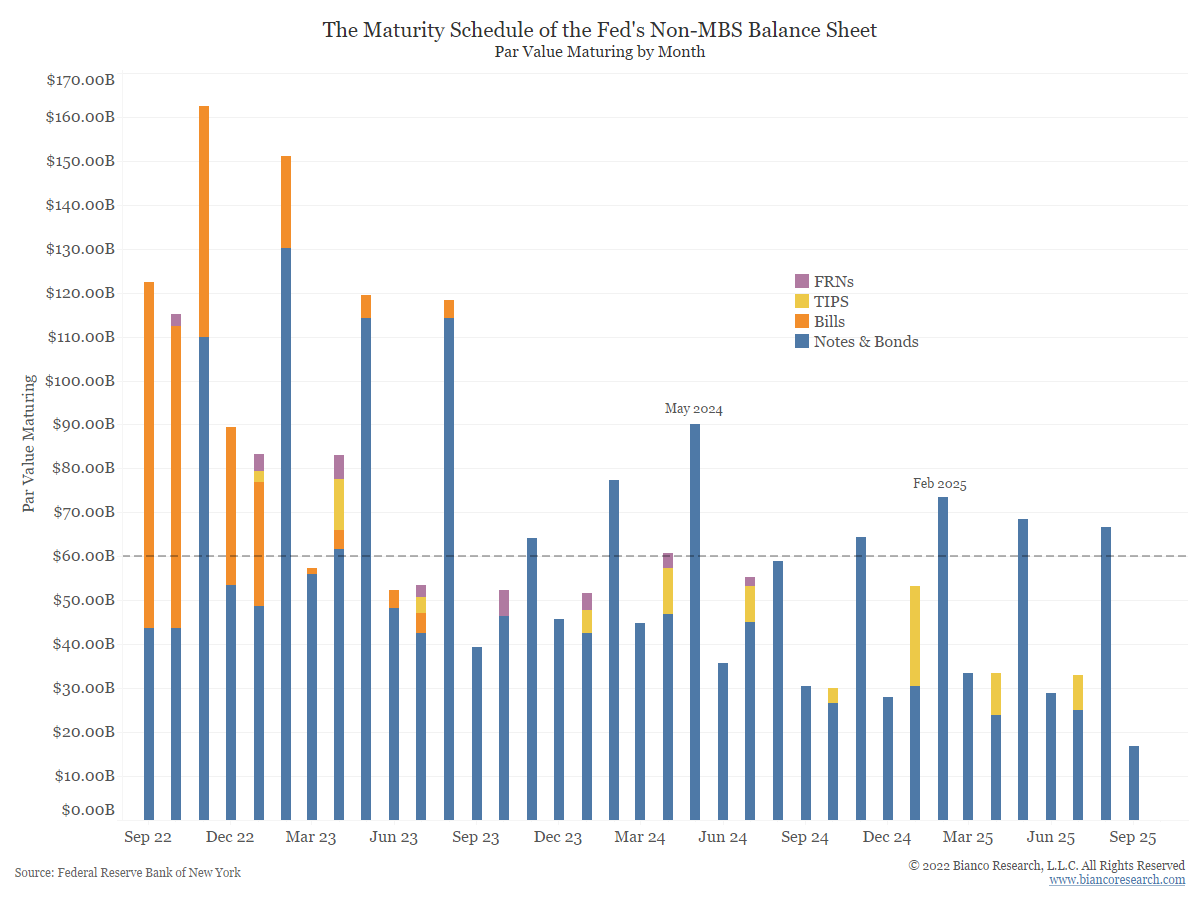

This chart shows the bonds that mature every month with $60B noted (line)

THE FED DOES NOT SELL ANYTHING, THEY JUST BUY $60B LESS THAN MATURES EACH MONTH.

The months that less than $60B mature, the Fed will run down the T-Bill Holdings to cover the shortfall.

This chart shows the bonds that mature every month with $60B noted (line)

THE FED DOES NOT SELL ANYTHING, THEY JUST BUY $60B LESS THAN MATURES EACH MONTH.

The months that less than $60B mature, the Fed will run down the T-Bill Holdings to cover the shortfall.

8/9

The Fed can do this for two years with changing anything.

What the Fed hopes for banks can attract RRP back via higher rates and "offset" the liquidity crunch of QT.

But the Fed does not control deposit rates or RRP usage.

Dudley explained

www.bloomberg.com/opinion/articles/2022-09-08/federal-reserve-quantitative-tightening-won-t-trigger-m...

The Fed can do this for two years with changing anything.

What the Fed hopes for banks can attract RRP back via higher rates and "offset" the liquidity crunch of QT.

But the Fed does not control deposit rates or RRP usage.

Dudley explained

www.bloomberg.com/opinion/articles/2022-09-08/federal-reserve-quantitative-tightening-won-t-trigger-m...

9/9

Bottom line, the Fed sees absolutely no reason to stop QT, the liquidity exists outside banks in RRP.

If markets are slammed, the Fed thinks banks can jack deposit rates and get liquidity back from RRP.

The Fed can stay with the inflation fight as market crumble.

Bottom line, the Fed sees absolutely no reason to stop QT, the liquidity exists outside banks in RRP.

If markets are slammed, the Fed thinks banks can jack deposit rates and get liquidity back from RRP.

The Fed can stay with the inflation fight as market crumble.