Thread

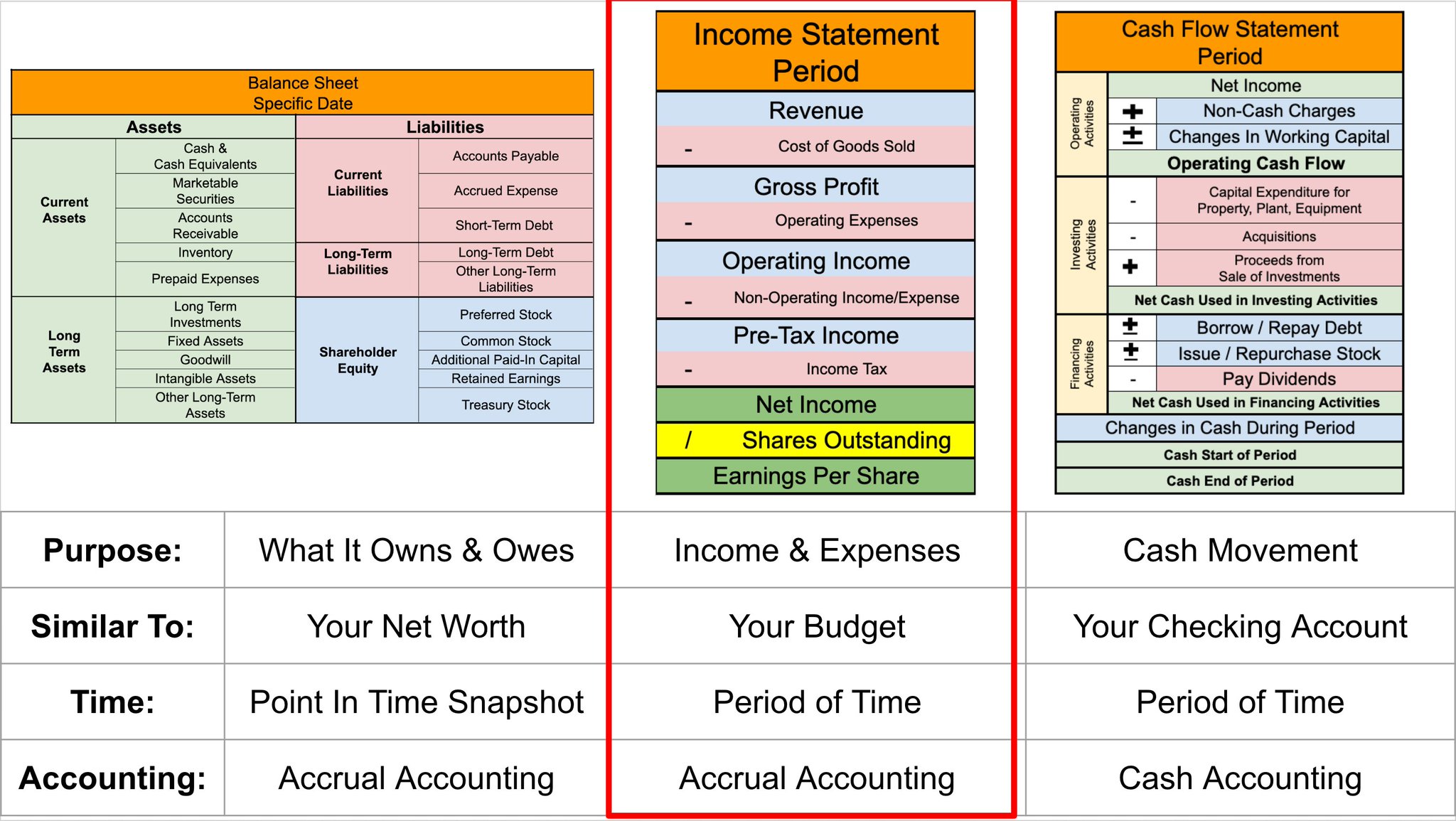

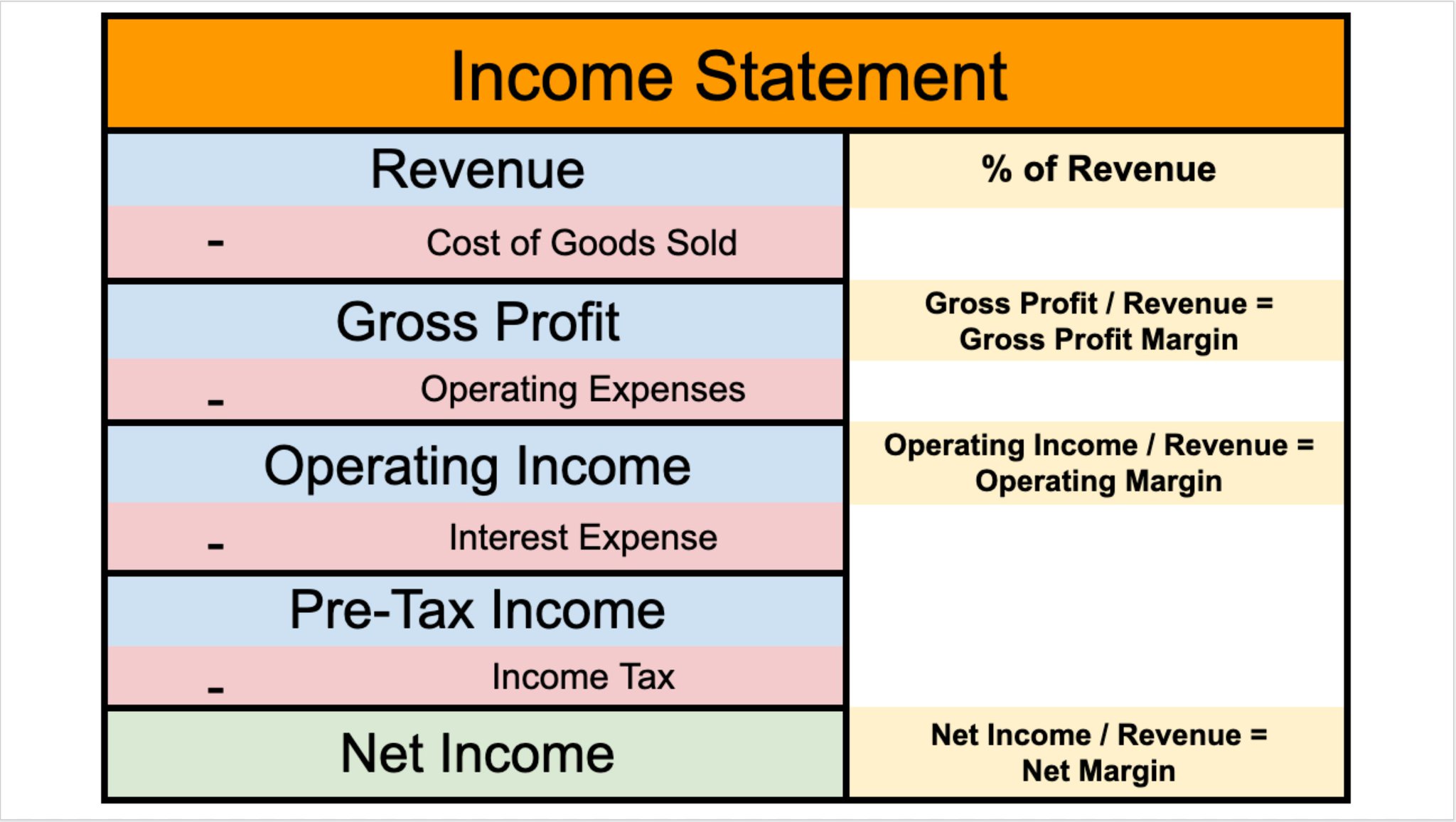

The income sheet is one of the three major financial statements.

It shows a company’s:

▪️Revenue (Sales)

▪️Expenditures (Costs / Expenses)

▪️Net Income (Earnings, Profits)

Over a period of time.

It shows a company’s:

▪️Revenue (Sales)

▪️Expenditures (Costs / Expenses)

▪️Net Income (Earnings, Profits)

Over a period of time.

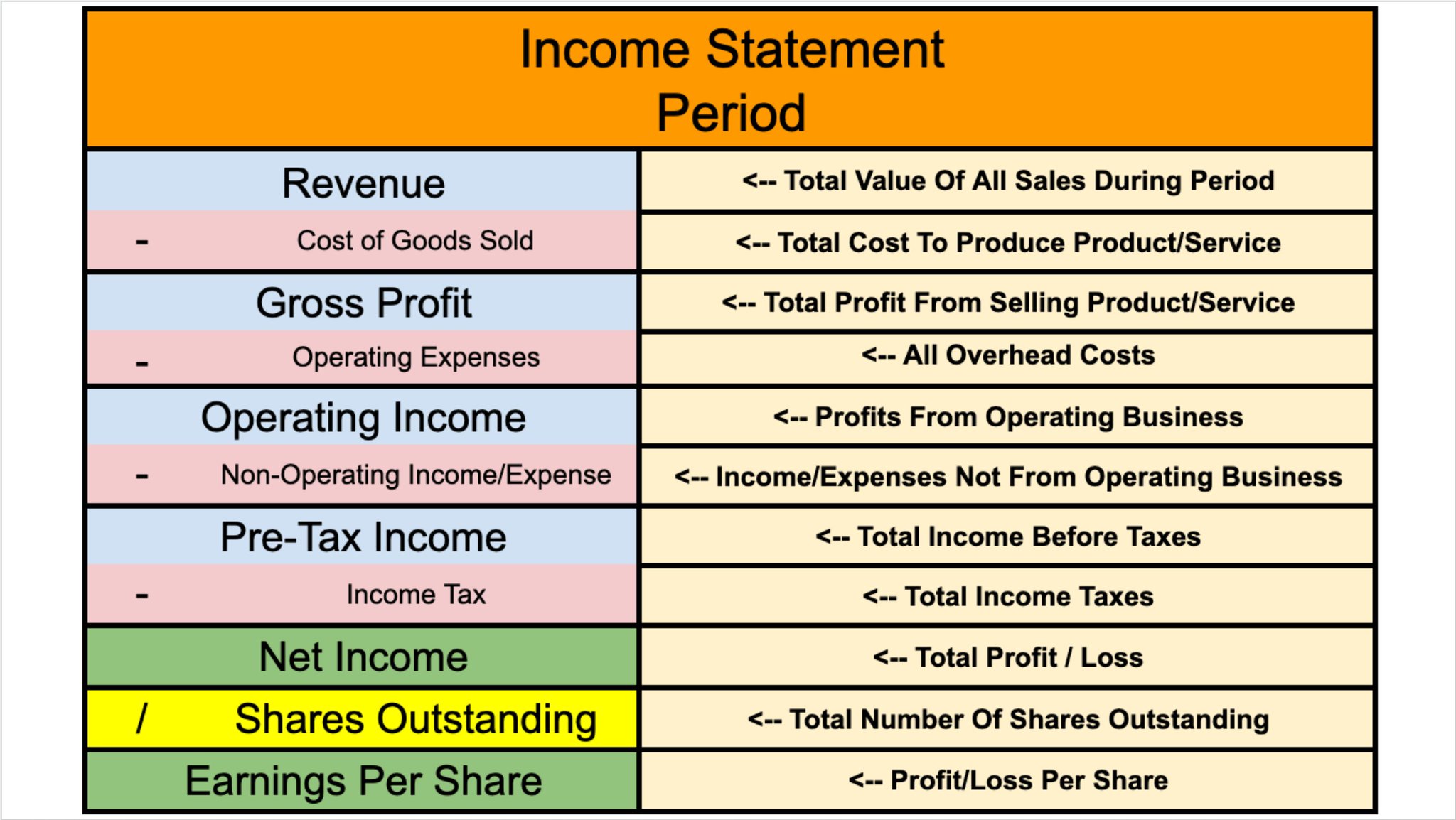

Management teams have leeway in categorizing their income statement.

This means that not all income statements look the same.

Here is a typical layout and the meaning of the most commonly used terms:

This means that not all income statements look the same.

Here is a typical layout and the meaning of the most commonly used terms:

Income statement answers two big questions:

1⃣ Is this company “profitable”?

2⃣ Is this company growing or shrinking?

1⃣ Is this company “profitable”?

2⃣ Is this company growing or shrinking?

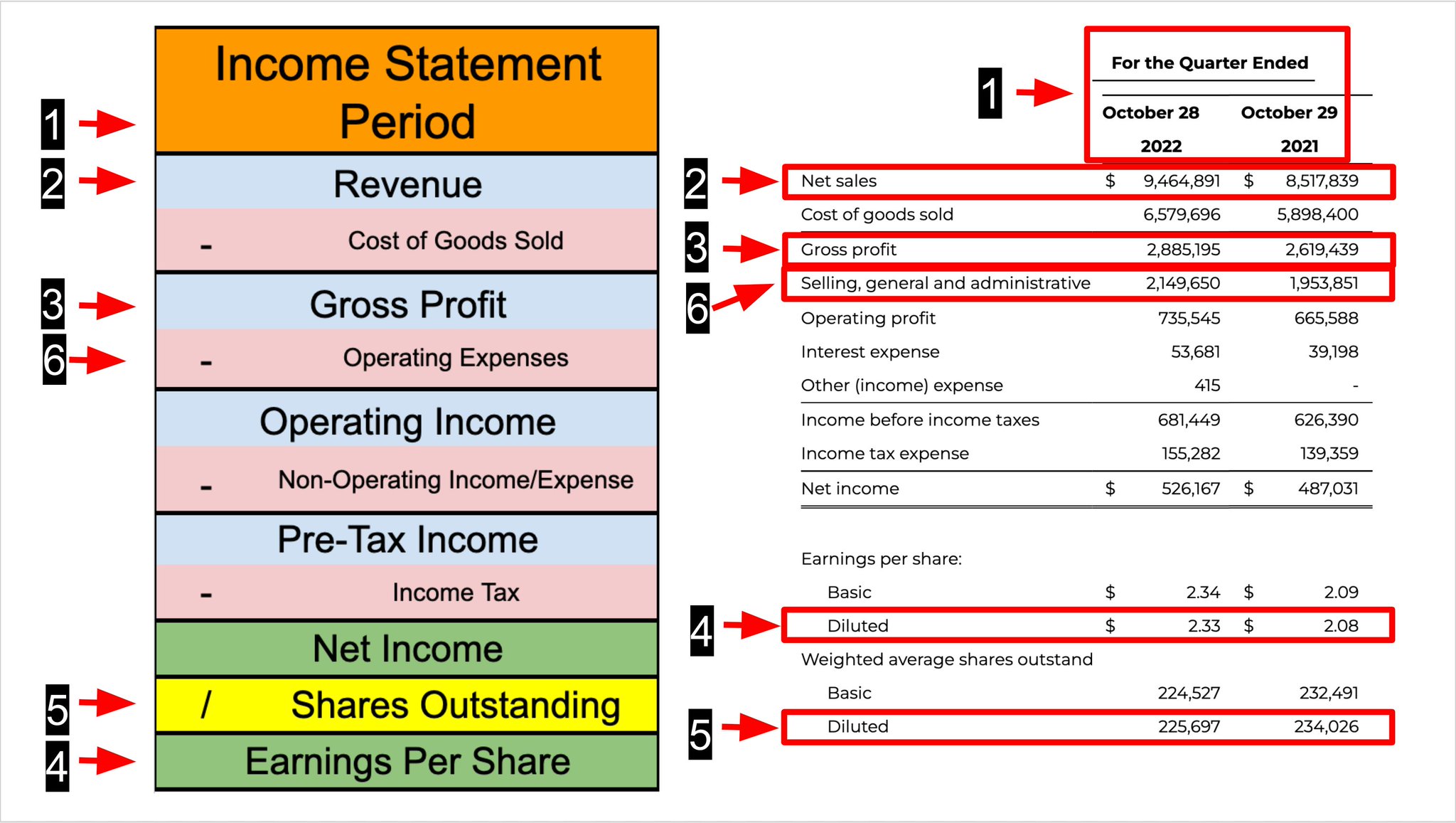

Here’s what I focus on first when looking at an income statement:

1⃣ Period: Quarter? Year?

2⃣ Revenue: Direction?

3⃣ Gross Profit: Direction?

4⃣ Earnings Per Share: Positive?

5⃣ Share Count: Direction?

6⃣ Operating Costs: Direction?

1⃣ Period: Quarter? Year?

2⃣ Revenue: Direction?

3⃣ Gross Profit: Direction?

4⃣ Earnings Per Share: Positive?

5⃣ Share Count: Direction?

6⃣ Operating Costs: Direction?

Best Possible Answers:

1⃣ Multiple Annual Periods

2⃣ Growing quickly

3⃣ Growing faster than revenue

4⃣ Growing faster than gross profit

5⃣ Declining

6⃣ Growing slower than revenue

1⃣ Multiple Annual Periods

2⃣ Growing quickly

3⃣ Growing faster than revenue

4⃣ Growing faster than gross profit

5⃣ Declining

6⃣ Growing slower than revenue

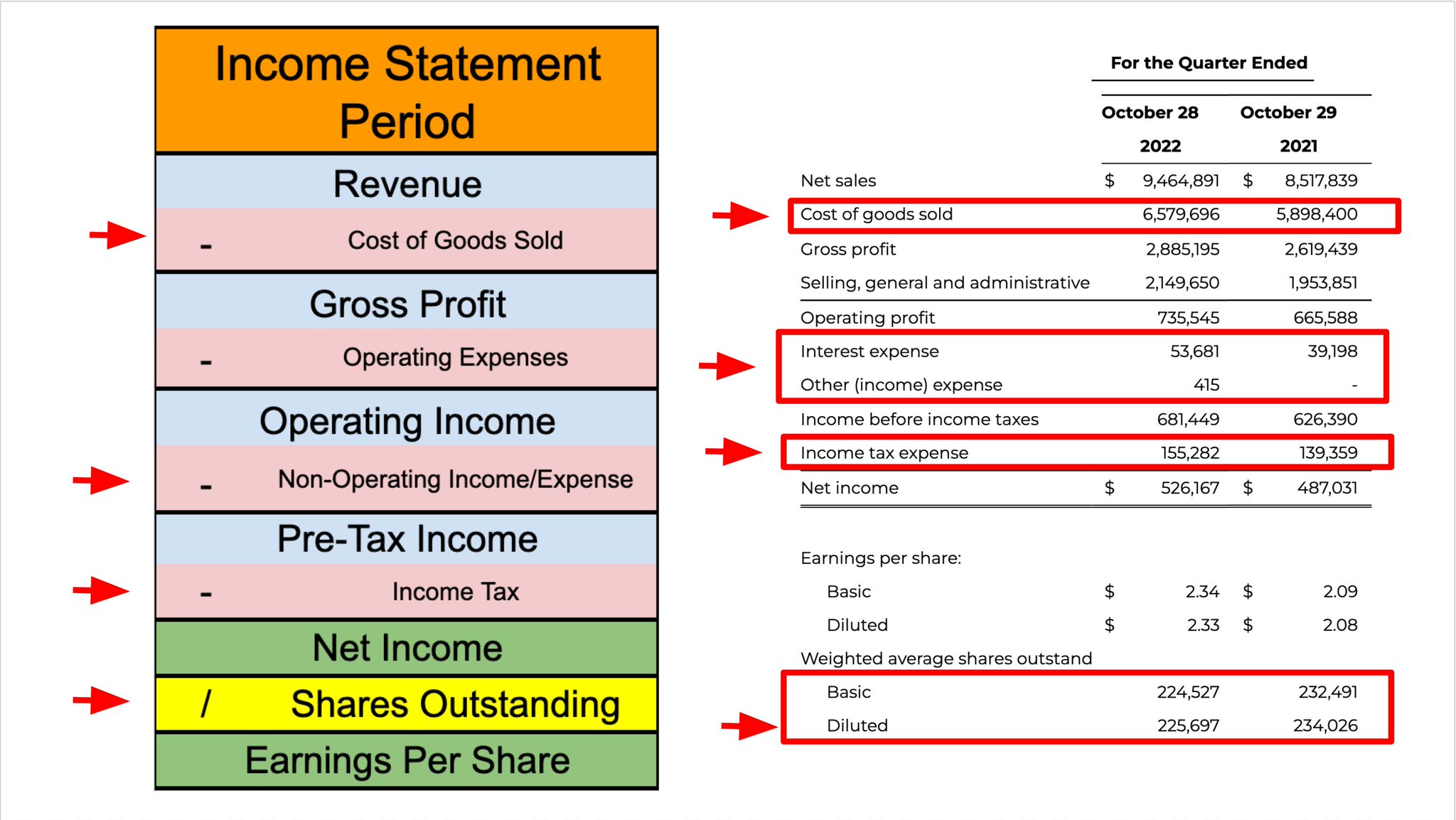

Other areas I quickly glance at:

▪️Cost of Goods Sold: Direction?

▪️Non-Operating: Any big changes?

▪️Tax Rate: Stable?

▪️Basic + Diluted Shares: Big difference?

▪️Cost of Goods Sold: Direction?

▪️Non-Operating: Any big changes?

▪️Tax Rate: Stable?

▪️Basic + Diluted Shares: Big difference?

It's also very helpful to look at margins.

Simply divide each line item by sales.

I focus heavily on gross margin, operating margin, and net margin:

Simply divide each line item by sales.

I focus heavily on gross margin, operating margin, and net margin:

Margins make it easy to compare a company to itself or its competitors.

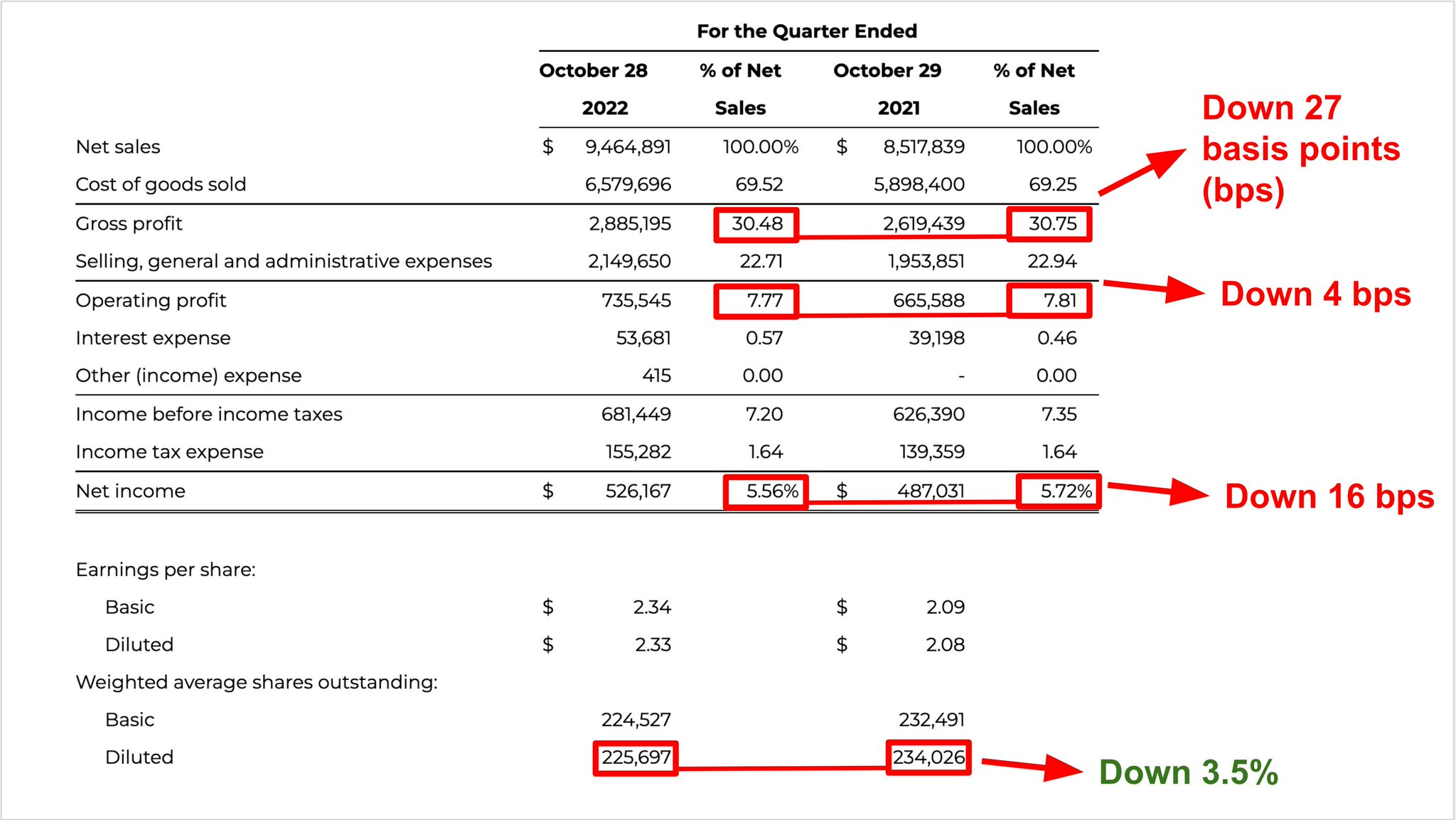

Small margin changes might not seem like a big deal, but they are!

The one to watch like a hawk: gross margin.

Here are $DG recent numbers:

Small margin changes might not seem like a big deal, but they are!

The one to watch like a hawk: gross margin.

Here are $DG recent numbers:

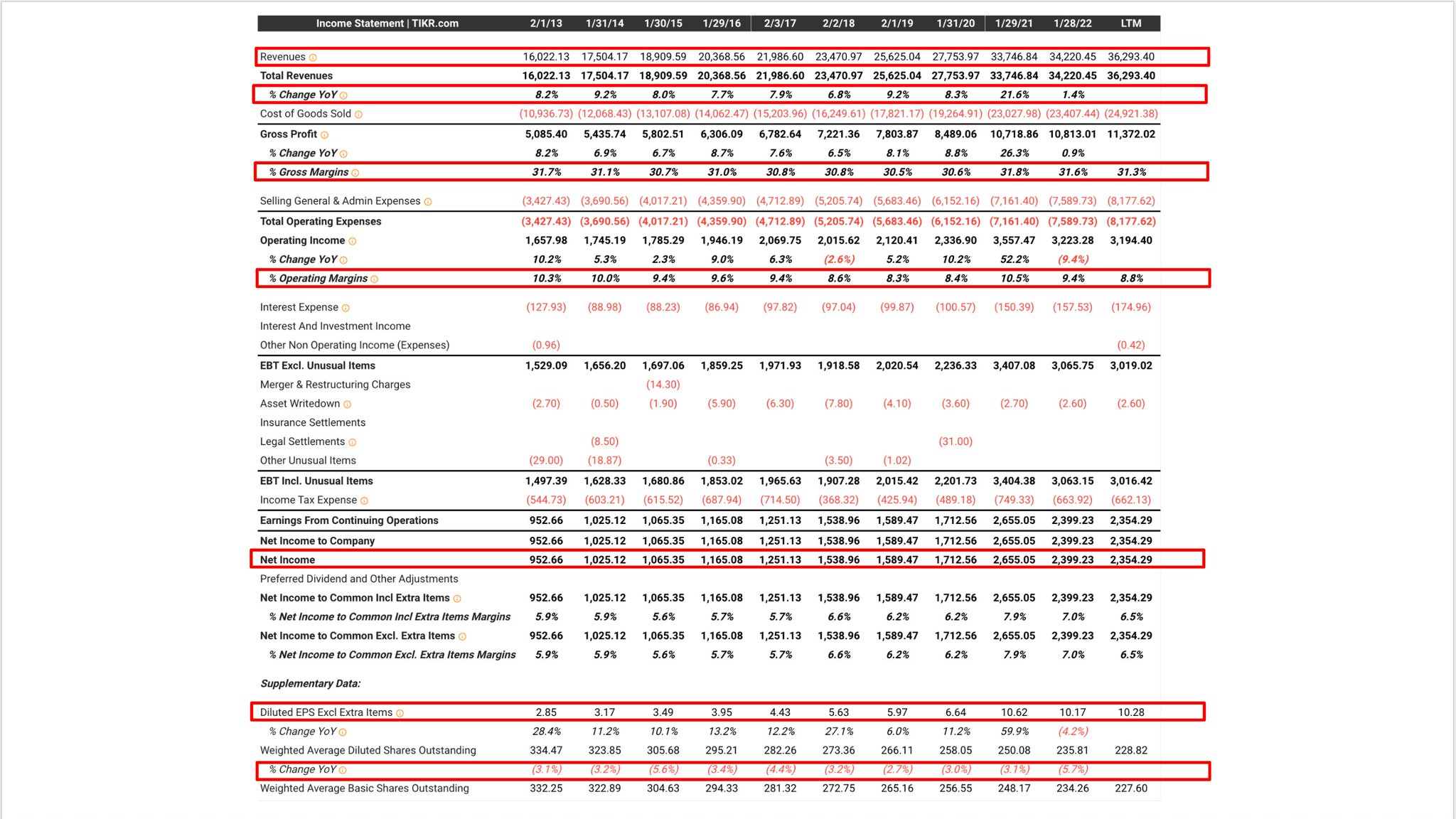

Income statements are most useful when measured over long periods of time.

Viewing $DG income statement over a decade shows how consistent it is.

Viewing $DG income statement over a decade shows how consistent it is.

I’d never make an investment without MUCH more analysis than this.

Accounting (and investing) is FILLED with nuance.

Still, with less than 2 minutes of analysis, you can quickly determine if a company is profitable, growing/shrinking, and worthy of a deeper dive.

Accounting (and investing) is FILLED with nuance.

Still, with less than 2 minutes of analysis, you can quickly determine if a company is profitable, growing/shrinking, and worthy of a deeper dive.

Learning to read financial statements is an incredibly important skill, but accounting is FILLED with nuance.

@Brian_Stoffel_ and I are teaching a live course in January that explains accounting in plain English.

Interested? DM me for a coupon code.

maven.com/brian-feroldi/financials

@Brian_Stoffel_ and I are teaching a live course in January that explains accounting in plain English.

Interested? DM me for a coupon code.

maven.com/brian-feroldi/financials

Enjoyed this thread?

I guarantee you'll love this other accounting thread I wrote about the balance sheet, too:

I guarantee you'll love this other accounting thread I wrote about the balance sheet, too:

Mentions

See All

Matt Gray @matt_gray_

·

Jan 7, 2023

This is GOLD