Thread by Tom Bridges

- Tweet

- Mar 8, 2023

- #Investment #EconomicGrowth

Thread

1. Some thoughts on Investment Zones 2.0 as they are being refocused to “catalyse a limited number of the highest potential knowledge-intensive growth clusters”. 🧵

www.ft.com/content/e001d0f4-0c70-4533-a529-f0e9fa5494ef

www.ft.com/content/e001d0f4-0c70-4533-a529-f0e9fa5494ef

2. In the context of some criticisms of previous IZ proposals, it is worth noting that the idea isn’t new. The late Prof Sir Peter Hall (hardly a right winger) advocated Enterprise Zones in 1977. Idea adopted in various forms (EZs, UDCs, MDCs) by successive Con & Lab governments

3. I thought the original IZ plans, while imperfect, were unfairly maligned. As I said at the time, with such an acute shortage of modern office, manufacturing & lab space in many parts of the UK, & when we need to accelerate growth, IZs can play a role. www.arup.com/perspectives/how-should-the-uk-develop-its-new-investment-zones-for-success

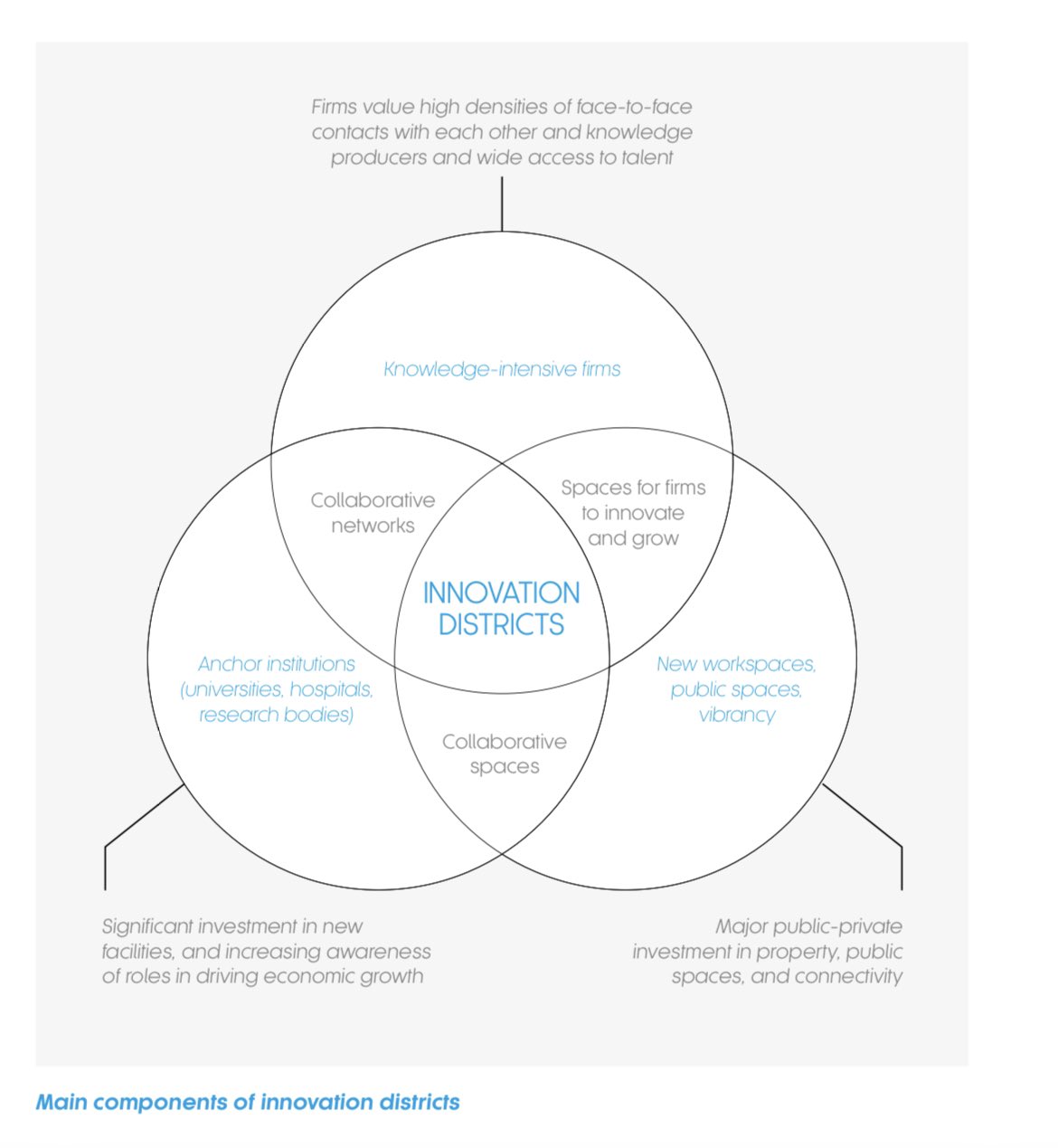

4. I also said there was an opportunity to focus IZs around innovation and innovation districts. Reallocating positive to see this happening, particularly in the context of the agenda across the political spectrum to make the UK a science superpower.

5. With growing momentum and ambitions plans around innovation districts in UK cities, the refocused approach to IZs could have great potential. I suggest 5 calls to action to maximise their success.

6. First, we need greater public sector R&D investment to crowd-in business investment. Some progress here, but as @ndrlee says, our competitors are way ahead. The US in particular is raising its game on place-based R&D through the CHIPS & Science Act. blogs.lse.ac.uk/politicsandpolicy/investments-zones-can-drive-innovation-if-we-learn-from-past-mistak...

7. We also need greater local influence / control of R&D investment. The innovation accelerators, currently proposed for W Midlands, Greater Manchester, and Glasgow, should be rolled out more widely.

www.ukspa.org.uk/the-uk-governments-levelling-up-white-paper-outlines-plans-for-three-new-innovation-...

www.ukspa.org.uk/the-uk-governments-levelling-up-white-paper-outlines-plans-for-three-new-innovation-...

8. Second, get the fiscal incentives right. Not convinced business rates relief is right answer. Better to allow councils to retain business rates in IZs for 30 years to create income stream to borrow against to reinvest in IZ infrastructure.

9. Third, introduce faster planning, not less planning. By setting out a spatial framework, places can provide clear signals to investors, and help ensure the right quality of development with good public realm & green infrastructure.

10. 4th councils / CAs / @HomesEngland should work together to develop right mechanisms for sharing risk & reward with private sector to get more office, innovation / lab, & manufacturing space built, which as @CentreforCities have said, is really needed. www.centreforcities.org/blog/city-centre-regeneration-shouldnt-focus-on-housing/

11. Link innovation assets in city centres with growth opps in surrounding areas. e.g. Atom Valley in GM, assets in Humber focused on energy & industrial decarbonisation, linking Leeds city centre with assets in S Leeds, Bradford, Huddersfield & Wakefield. amp.theguardian.com/business/2023/jan/07/atom-valley-andy-burnhams-vision-for-regenerating-great-manc...

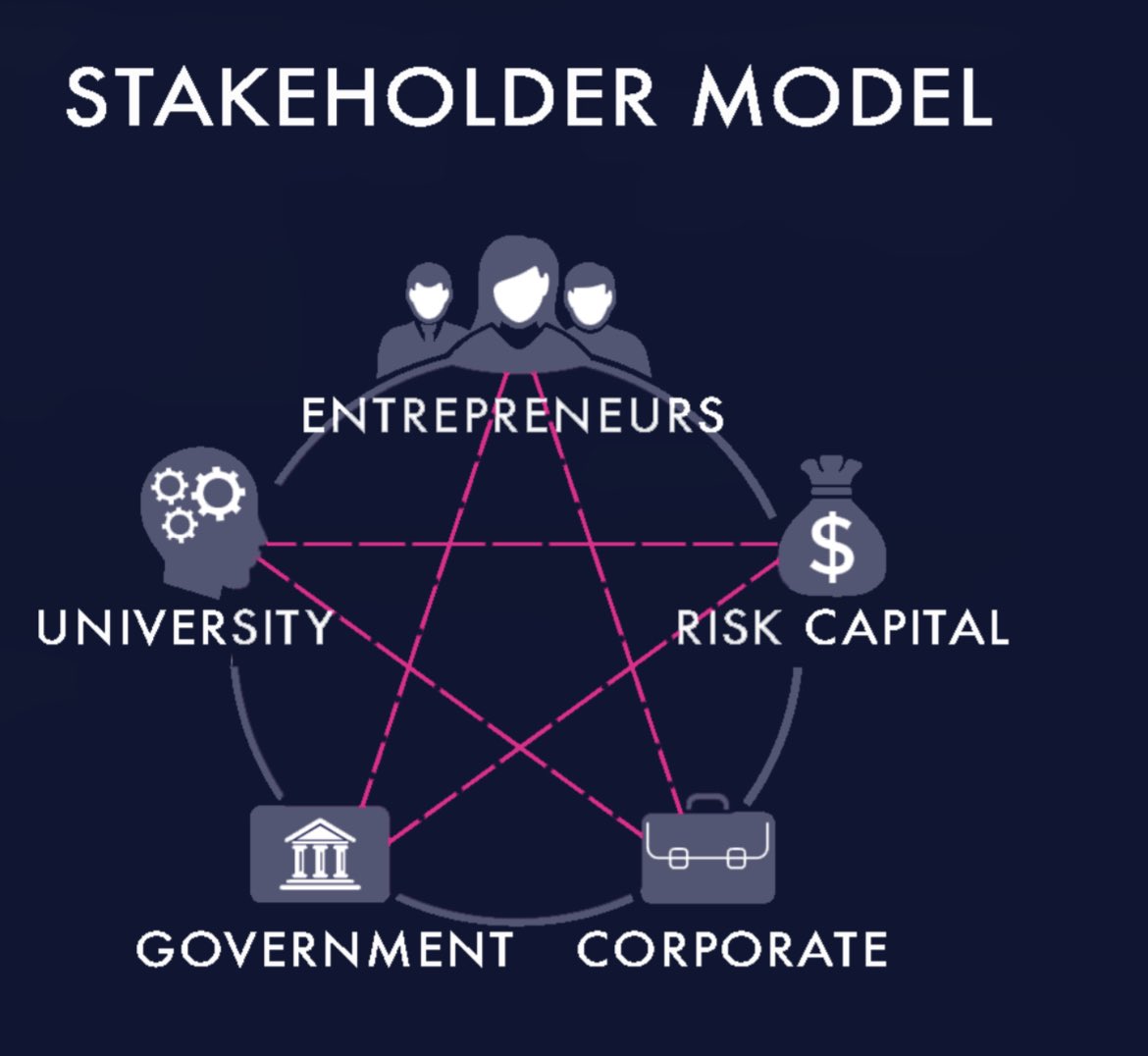

12. Think beyond bricks & mortar. There should be a focus on building the softer ecosystem to commercialise innovation. MIT through their @MIT_REAP framework have identified the main actors that need to work together. In short we need to do the R not just the D.

13. Align innovation / universities / IZs with inward investment. @AlextoFavier doing some great work in this space, as is @jennyshartley.

14. Create a network of testbeds in IZs to enable innovators and entrepreneurs to test their solutions and their use cases in real-world conditions.

www.arup.com/projects/real-world-testbeds

www.arup.com/projects/real-world-testbeds

15/15. Focusing Investment Zones 2.0 on innovation is really positive. To maximise their potential we need to position them as part of wider strategies for growth, a plan-led approach and greater investment (with more local influence) in R&D.